Mega Whales Accumulate Bitcoin as Mid-Sized Holders Hint at a Sentiment Shift

Mega Bitcoin whales continue aggressive accumulation, while mid-sized holders hover at a tipping point—raising questions about whether the broader market is ready to follow.

Bitcoin’s most powerful investors—dubbed “mega whales”—have resumed aggressive accumulation, potentially signaling a turning point in the crypto market. On-chain analytics firm Glassnode has highlighted the resurgence of large-scale buying behavior, while other cohorts begin to show signs of a similar shift.

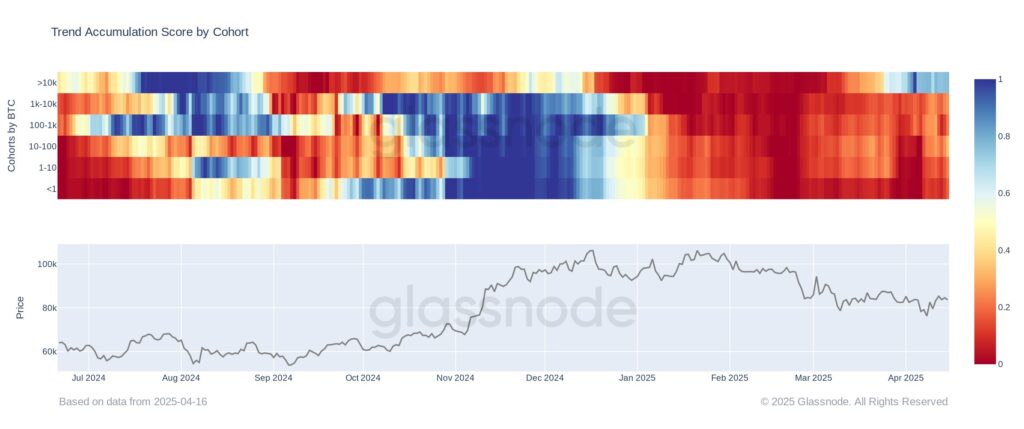

The analysis revolves around the Accumulation Trend Score, a weighted indicator that assesses whether wallets are net buyers or sellers. The metric considers both balance changes and the size of wallets, meaning that actions by large holders have a disproportionate effect on the final score.

Online advertising service 1lx.online

When the Accumulation Trend Score is above 0.5, accumulation is occurring. A value closer to 1 indicates strong buying, while values below 0.5 suggest distribution or a lack of meaningful accumulation.

Glassnode’s recent report doesn’t examine this score across the entire market in aggregate, but instead focuses on wallet-based cohorts—divided by the amount of BTC held. One cohort, in particular, has made a standout move: wallets holding 10,000+ BTC, or what many analysts call mega whales.

A chart shared by Glassnode shows that back in February, the indicator was deep red for all cohorts, reflecting aggressive selloffs across the board. Since then, most groups have moved away from distribution, showing reduced selling pressure. However, only the mega whales have decisively flipped into bullish territory.

“These mega whales began buying in March,” Glassnode noted. “Their accumulation has intensified, with a score now around 0.7.”

Meanwhile, other cohorts—such as those holding 10 to 100 BTC—are edging toward the threshold. These mid-sized investors now show a neutral trend, with the score hovering around 0.5.

“This suggests a possible shift in sentiment from mid-sized holders,” the report adds.

Cohorts like 100 to 1,000 BTC and smaller holders are still showing weak signals. The divergence between mega whales and the rest of the market highlights a key question: will the smaller players follow suit?

“We’ll have to see whether the rest of the market catches up—or continues to hesitate.”

Online advertising service 1lx.online

BTC Price Context:

Bitcoin itself has moved sideways during this period. As of writing, it continues to hover around $84,500, signaling market indecision.

Still, if the Accumulation Trend Score continues to rise among smaller holders, the market could be poised for a broader momentum shift. The mega whales may be early, but whether they are right—depends on whether the others follow.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)