Binance Coin Local Reversal Hints at Potential Drop to $560 – Will Bulls Step In?

Binance Coin (BNB) experienced an instant local reversal after a surge in liquidations, raising the possibility of a correction to $560 before climbing higher in Q4, typically a bullish period for crypto.

Binance Coin [BNB], currently the fourth-largest cryptocurrency by market cap, has gained attention following a sharp local reversal triggered by a spike in liquidations. This comes in the wake of the release of Binance’s former CEO, CZ, who had been detained for four months due to U.S. money laundering allegations.

Online advertising service 1lx.online

The surge in BNB following this development was quickly met with significant liquidations across several BNB pairs, which led to an instant local price reversal. Now, the crypto market is speculating whether this correction could extend to the $560 level before the coin resumes its upward trend in Q4, a period known for bullish market sentiment.

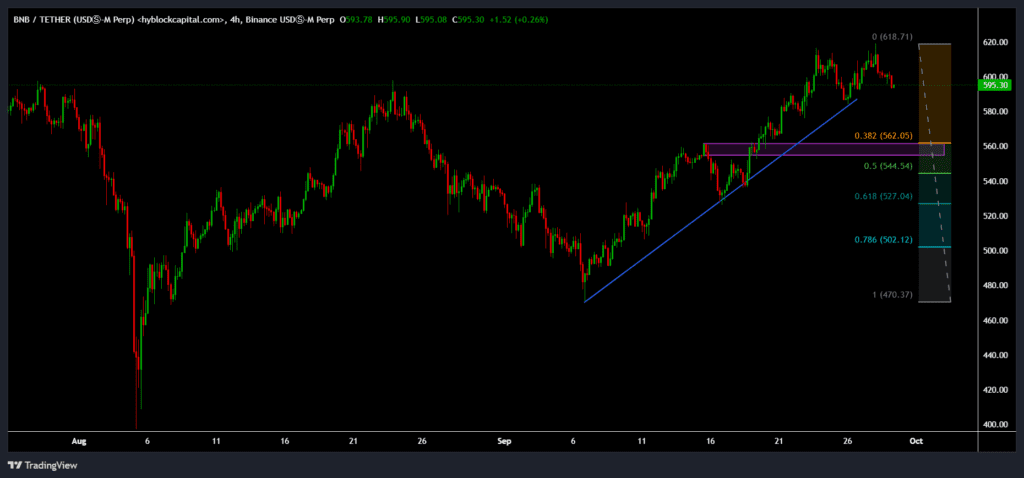

BNB’s Recent Price Action

For the past three weeks, BNB/USDT has been in a steady uptrend, showing consistent higher highs and higher lows on the 4-hour chart. This trend reflects a balanced mix of both short-term and long-term price movements. The upward momentum hit resistance at $620, forming a double top, which often signals the possibility of a price retracement.

If BNB breaks below the neckline of this double top, a correction down to $560 could be on the cards. This level aligns with the 0.382 Fibonacci Retracement, which often acts as a support level during healthy upward trends. Should the price dip to $560, traders may see it as an ideal buying opportunity, particularly as BNB could still target the $800 mark, yielding a potential 40% return.

Market Indicators Suggest a Correction

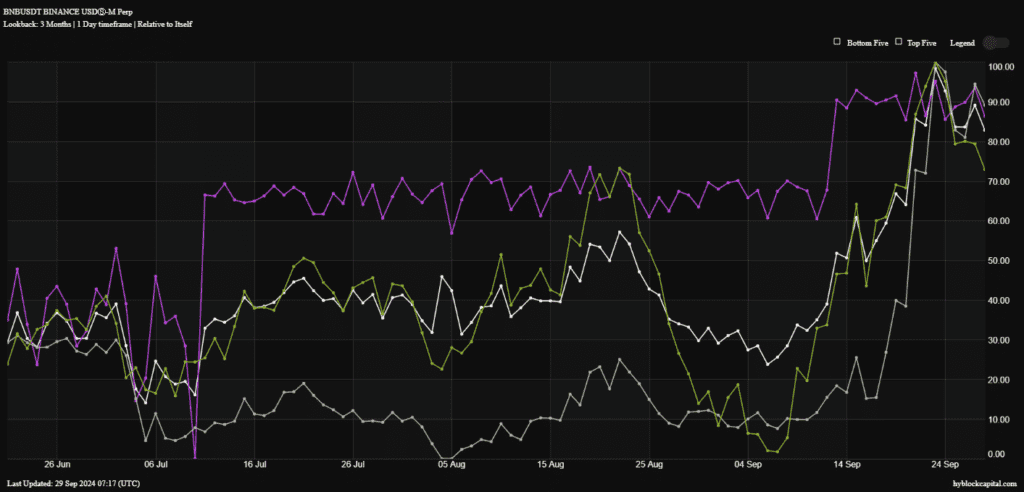

Several metrics point towards a possible correction for BNB. The net longs/shorts delta, which tracks the balance between buyers and sellers, has dropped from its peak and now stands at 86%, indicating that buyer momentum has slowed. Similarly, open interest has decreased to 89%, further supporting the likelihood of a pullback.

Additionally, the whale vs retail delta, which tracks large holders’ activity versus retail traders, has shown a notable decline. Whale dominance has fallen by nearly 40% over the past three months, signaling reduced whale participation—a potential indicator of an impending market pullback.

Online advertising service 1lx.online

Will BNB Drop to $560?

While the market shows signs of a potential correction, BNB’s overall uptrend remains strong. If the price does correct to $560, it could present an excellent entry point for traders looking to capitalize on the next leg up. If BNB can hold this support level, it could resume its upward trend, possibly reaching $800 by the end of Q4, a period known for its bullish market conditions.

As traders continue to monitor these developments, BNB’s next few price movements could be pivotal in determining whether it sustains its upward momentum or corrects further.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)