Bitget Slashes Stock-Futures Fees by 90% as Daily Volume Surpasses $300 M — Big Bet on Cross-Asset Growth

Bitget has announced an aggressive fee campaign: a 90% reduction in stock-futures trading fees, coinciding with one of its daily volumes topping $300 million. This shift marks a strategic pivot from purely crypto assets into broader financial markets — and in doing so highlights the widening overlap between Web3 infrastructure and traditional finance.

You can explore more updates and market stories in our dedicated Cryptocurrency News section.

What the Fee Cut Means & Why Now

Online advertising service 1lx.online

Bitget’s press release confirms that starting early November 2025 the exchange will offer stock-futures pairs at an ultra-low fee of 0.0065% (down from typical 0.06% or higher), representing a 90% reduction.

The timing is significant:

- U.S. equities and tech stocks are surging under an AI-investment narrative.

- Retail and institutional traders are seeking tokenised access to stocks with crypto-style leverage and settlement.

- Bitget reported its stock-futures volume hit the $300 million/day mark, signalling demand.

- A promotion window runs until Jan 31, 2026 (UTC+8) for the fee cut.

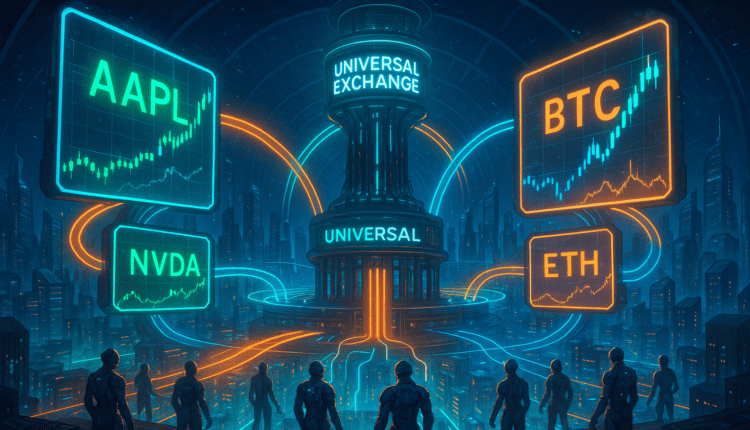

From a business vantage, this move suggests Bitget is doubling down on its “Universal Exchange (UEX)” model — merging crypto derivatives, tokenised stocks and real-world assets under one umbrella. By slashing fees dramatically, Bitget aims to capture flows that might otherwise stay with traditional CFD or brokerage platforms.

Implications for Traders & the Crypto-Exchange Landscape

Trader benefits & risks

For active traders, the ultra-low fees reduce cost friction significantly — especially for frequent high-volume stock-futures users. It also lowers the barrier for crypto-native traders to diversify into traditional equities via tokenised formats.

However, some risks emerge:

- Lower fees can increase churn and speculative volume, raising platform risk (liquidity, counterparty).

- Tokenised stock-futures remain a regulatory grey zone in many jurisdictions.

- Conversion flows between crypto and stocks may create hidden leverage/unwinding risk.

Online advertising service 1lx.online

What it signals about exchange competition

This move speaks to a broader competitive shift: crypto exchanges are not just fighting for BTC/ETH spot volume anymore; they’re competing on cross-asset, hybrid models. Fee wars may be reigniting — but in a new domain.

Older coverage on BTCNews.space has explored exchange fee-cuts in crypto derivatives, but this is more expansive — it blends tokenised equities + crypto derivative infrastructure. That matters strategically.

Underlying Drivers & Structural Context

Tokenised equities + crypto derivatives synergy

Online advertising service 1lx.online

The launch of tokenised stock futures represents the convergence of TradFi and Web3. Bitget previously listed US-stock token futures (AAPL, TSLA, NVDA etc) in August 2025.

By coupling that with this pricing initiative, Bitget may be betting that the next wave of growth in trading volume lies in hybrid asset classes, not purely crypto.

Fee elasticity and user-flow engineering

From a strategic lens: lowering fees aggressively is a way to acquire market share, gather user data, build long-term relationships, then upsell value-added services (premium tools, staking, tokenised assets). It’s reminiscent of early exchange growth phases — but now extended into stocks.

If successful, this could reshape how volume flows across the ecosystem:

- Crypto natives may direct collateral into stock token derivatives.

- Traditional equity traders may begin using crypto-exchange syntax (24/5 trading, leveraged futures) for stocks.

- Crypto exchanges may increasingly become multi-asset hubs rather than purely spot/crypto derivatives platforms.

Long-Term Outlook & Macro Considerations

Will other exchanges follow?

If Bitget’s experiment proves sticky (i.e., users stay beyond the promo, cross-asset flows grow), rivals may feel compelled to match or exceed the pricing. That could trigger a broader fee spiral across tokenised asset futures.

Regulatory and risk surveillance

Tokenised stocks on crypto exchanges raise questions around:

- Securities regulation (since stocks often imply ownership rights)

- Market-manipulation risk across crypto and equity blurring lines

- Settlement/custody infrastructure for hybrid assets

Exchanges will need robust compliance and transparency to avoid regulatory backlash — and this may limit how far they can go.

Impacts on crypto-native markets

Interestingly, while the move is about stocks, there are real knock-on effects for crypto ecosystem:

- Liquidity may shift from pure crypto derivatives into stock derivatives, altering margin/capital flows.

- Tokenised equities could attract institutional capital previously reserved for TradFi, bringing it into exchange platforms that still require crypto infrastructure.

- This may accelerate tokenization of more asset classes (commodities, real estate etc) via exchange models.

For those following the long-range bitcoin price forecast, this is a reminder: the asset class is maturing not just in isolation, but as part of a broader asset-tokenisation wave.

Key Takeaways for the Crypto Community

- Fee strategy is becoming part of differentiation — not just token listings or yield programs.

- Universal exchange models (crypto + stocks + real-world assets) may define the next platform era.

- Traders should monitor whether the volume growth is durable or just promotional hype — structural change matters more than short-term metrics.

- Regulatory risk is elevated when crossing crypto ↔ equity boundaries — savvy traders and institutions will watch compliance and risk controls closely.

This move by Bitget potentially marks a pivot point in how crypto-exchanges view their role. It’s no longer solely about Bitcoin, Ethereum or DeFi markets — it’s about access to global asset flows in a seamless platform.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)