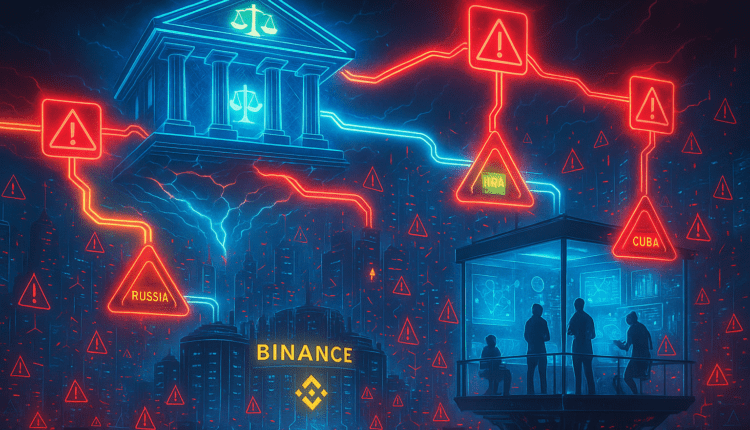

Binance Faces Fresh Accusations of Money-Laundering Links to Russia, Iran & Cuba

Newly resurfaced allegations claim that Binance was used to process money-laundering flows connected to Russia, Iran, and Cuba — a development that once again places the world’s largest crypto exchange at the center of regulatory scrutiny. This renewed pressure is emerging at a critical moment for global crypto oversight.

You can explore more updates and market stories in our dedicated Cryptocurrency News section.

The Allegations: What Sparked the New Controversy

Online advertising service 1lx.online

A detailed analytical report, resurfacing this week, outlines a series of alleged money-laundering pathways connected to Russia, Iran, and Cuba, claiming that illicit actors may have used Binance’s infrastructure to move funds across borders.

The report highlights new patterns in wallet activity and cross-chain transfers, suggesting potential enforcement exposure beyond previous investigations.

According to recent Cryptocurrency News insights, the exchange has already been under pressure for more than a year as regulators worldwide increase monitoring of cross-border crypto flows.

Binance’s Position and Public Response

Binance has denied the allegations, emphasizing its upgraded compliance stack and new leadership following its strategic reorganization. The company notes:

- Expanded KYC & AML screening tools

- Deepened cooperation with global law-enforcement

- Strengthened on-chain monitoring systems

Despite this, concerns remain that the accusations could influence how U.S. and EU regulators shape their next wave of enforcement actions.

This is not the first time Binance has faced scrutiny. Previous investigations were covered in our archive, including the 2023 compliance overhaul and the 2024 cross-jurisdictional probe — both available via our BTCNews.space archive.

On-Chain Evidence & Global Enforcement Context

The allegations reference on-chain traces visible through institutional analytics platforms (Glassnode, CryptoQuant, Arkham Intelligence), with emphasis on:

Online advertising service 1lx.online

■ Flow clustering between sanctioned regions

Clusters allegedly show wallets tied to Russia-connected entities routing funds through intermediary accounts before hitting centralized exchanges.

■ Multi-chain bridging to obscure origins

Activity reportedly blended stablecoin transfers across various networks to mask source jurisdictions.

■ Fiat on-off ramps under renewed review

Online advertising service 1lx.online

Regulators are said to be re-examining the exchange’s historical fiat access points tied to Eastern Europe and the Middle East.

Such claims amplify concerns about global crypto exchange oversight, especially at a time when Bitcoin, TON, and Ethereum ecosystems have become deeply intertwined through rapidly growing liquidity pathways. (See our related coverage in the Ethereum News category.)

What This Means for Users

For everyday traders, the situation highlights growing regulatory unpredictability. Potential outcomes include:

- Tighter KYC checks for high-risk regions

- More aggressive law-enforcement cooperation between countries

- Potential liquidity disruptions if compliance demands intensify

- Higher transparency requirements for all major exchanges

While nothing in the allegations confirms direct wrongdoing by Binance, the narrative alone can shape market sentiment — particularly as institutions reassess counterparty risks.

Long-Term Outlook: Could This Trigger Global Policy Changes?

Regulatory bodies in the U.S., EU, and Asia have already outlined future frameworks that categorize crypto exchanges alongside traditional financial institutions.

Renewed allegations like these could accelerate:

- Unified international AML standards

- Automatic cross-border reporting

- Mandatory transparency for on-chain flows

- Broader risk-scoring of crypto platforms

For now, Binance remains operational worldwide, but the pressure suggests that the next 12 months may define how much regulatory transformation the exchange — and the entire crypto sector — must undergo.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)