How to measure risk in cryptocurrency: beginner-friendly guide explaining volatility, liquidity, and key risk indicators.

Table of Contents

- Introduction

- Why Risk Analysis Matters in Crypto

- Volatility: The Core Risk Metric

- Liquidity: The Invisible Risk Factor

- Additional Risk Factors Beginners Must Track

- How to Create a Simple Beginner-Friendly Risk Model

- Future Forecasts: How Risk Will Change by 2030

- Conclusion

Online advertising service 1lx.online

Introduction

Understanding how to measure risk in cryptocurrency is essential for beginners who want to invest safely “on the topic of the article.” Crypto assets are fast, volatile, and unpredictable — but with the right tools, even a new investor can analyze volatility, liquidity, and other indicators to make smarter decisions.

This guide explains how risk works, how to measure it, which metrics matter most, and how beginners can manage their portfolio with confidence.

Why Risk Analysis Matters in Crypto

Crypto is not like traditional finance.

Bitcoin can move 5% in an hour. Altcoins can rise 300% in a week — or crash 70% overnight.

Because of this speed, measuring risk “on the topic of the article” helps beginners avoid:

- panic buying

- emotional decisions

- liquidity traps

- scams

- overexposure to unstable assets

A smart investor analyzes risk before profit.

Volatility: The Core Risk Metric

Online advertising service 1lx.online

Volatility is the foundation of crypto risk. It shows how fast and how strongly the price changes.

1. What Volatility Means

Volatility measures price instability.

High volatility = big unpredictable moves.

Low volatility = stable, slow price behavior.

Beginners often mistake volatility for “opportunity.”

In reality, volatility is risk.

Online advertising service 1lx.online

2. How to Measure Volatility

Beginners can use simple tools:

- Daily % change

- ATR (Average True Range)

- Bollinger Bands width

- Standard deviation of returns

- Volatility index on exchanges

If a coin regularly swings 10–20% in hours, risk is extremely high.

3. Why Volatility Is Higher in Crypto

Crypto is more volatile because:

- markets work 24/7

- liquidity is lower

- whales control large percentages

- news spreads instantly

- no centralized price control

- global retail speculation

This makes risk measurement “on the topic of the article” absolutely necessary.

Liquidity: The Invisible Risk Factor

Liquidity determines how easily you can buy or sell crypto without affecting the price.

Low liquidity means your order moves the market.

High liquidity = safer.

1. What Liquidity Shows

Liquidity tells you:

- how many buyers and sellers are available

- how deep the order book is

- whether you can exit your position fast

- how stable the price is

Many beginners lose money because they enter low-liquidity coins.

2. How to Measure Liquidity

Key metrics:

- 24h trading volume

- CEX liquidity score

- DEX pool depth

- Bid-ask spread

- Order book density

If spread is large, risk is enormous.

3. Liquidity Traps

A liquidity trap happens when:

- a coin pumps artificially

- real buyers disappear

- sellers cannot exit without crashing price

Common in memecoins and new launches.

Avoid illiquid assets unless you’re ready for high risk.

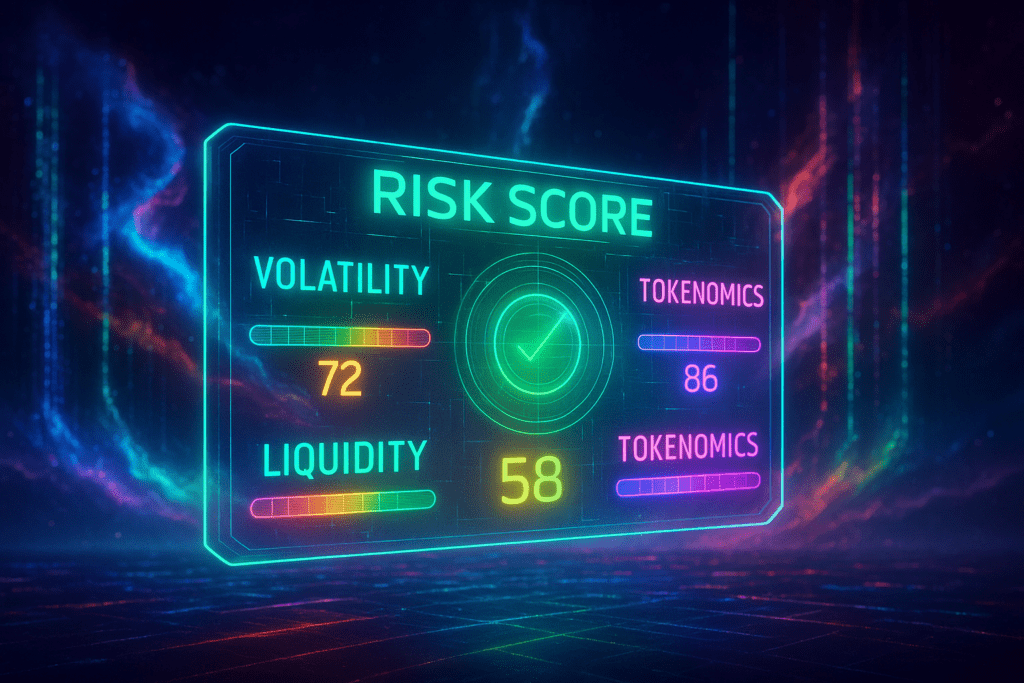

Additional Risk Factors Beginners Must Track

Beyond volatility and liquidity, risk also comes from:

- tokenomics (inflationary supply = long-term loss)

- team transparency

- centralization of whales

- regulation

- exchange reliability

- smart-contract vulnerabilities

- project activity

A strong project has stable liquidity, moderate volatility, and predictable fundamentals.

How to Create a Simple Beginner-Friendly Risk Model

A basic model for evaluating any asset:

| Category | Score 1–5 | Notes |

|---|---|---|

| Volatility | Low score = safer | Check recent price swings |

| Liquidity | High score = safer | Check 24h volume & spread |

| Tokenomics | Stable supply = safer | Inflation = risk |

| Team & transparency | Verified team = safer | Anonymous = risk |

| Utility | Real use case = safer | Meme-only = risk |

| Security | Audits = safer | Exploits = red flag |

Total score:

- 24–30 → Low risk

- 17–23 → Medium

- 10–16 → High

- 0–9 → Extreme risk

Simple but effective.

Future Forecasts: How Risk Will Change by 2030

Risk in crypto will evolve:

- AI tools will predict volatility more accurately

- global regulation will reduce market manipulation

- liquidity will grow as institutions enter

- smart-contract systems will become safer

- real-world tokenization will stabilize markets

- advanced analytics will be accessible to beginners

By 2030, risk measurement will be easier — but volatility will never fully disappear.

Conclusion

Measuring risk in cryptocurrency “on the topic of the article” is the foundation of smart investing.

Volatility and liquidity are two pillars of risk analysis, and understanding them helps beginners avoid losses, plan long-term strategies, and confidently navigate fast-moving market conditions.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)