DeFi 2025: Fee-Based Rewards Surpass Tokens, Ushering In a New Era of Sustainable Liquidity

DeFi protocols are moving from token-based incentives to fee-driven rewards, signaling ecosystem maturity and resilience.

The decentralized finance sector is entering a new era of sustainable growth as a major shift unfolds in how liquidity providers are compensated. Once dominated by token incentives, DeFi platforms are now prioritizing fee-based rewards, offering long-term value and stability over short-term hype.

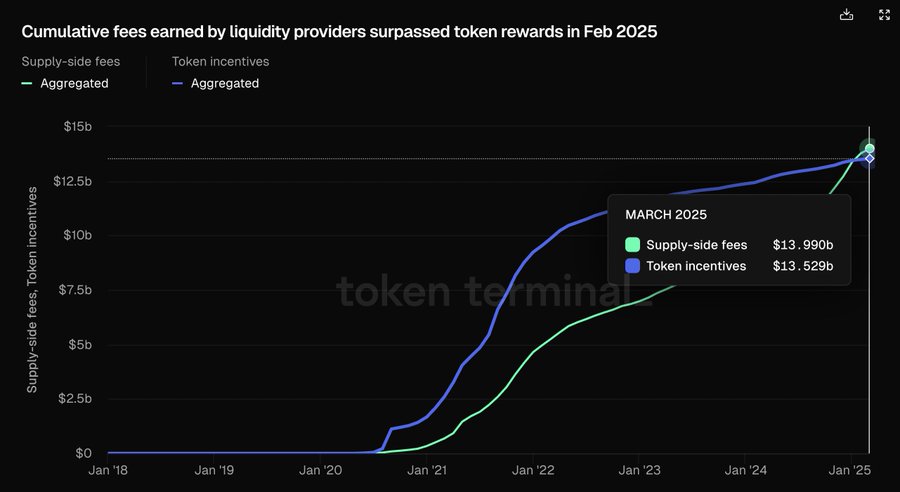

Recent data highlights this turning point: by March 2025, supply-side fees totaled $13.99 billion, surpassing token rewards which stood at $13.53 billion. This historic reversal marks a fundamental evolution in the DeFi economic model.

📉 From Farm-and-Dump to Fee Stability

Online advertising service 1lx.online

In DeFi’s early stages, platforms like Uniswap, Sushiswap, and Compound attracted users with governance token airdrops, yield farming, and other incentive schemes. While these tactics effectively bootstrapped liquidity and community, they also led to short-lived engagement.

As token prices dropped or incentives ran dry, users would abandon protocols, creating the notorious “farm-and-dump” cycle. Liquidity would disappear as fast as it arrived, undermining the protocol’s ability to grow sustainably.

📈 The Rise of Protocol Revenue

The new model revolves around organic protocol revenue. Instead of offering external token rewards, platforms now share transaction fees, staking returns, and yield from protocol activity with liquidity providers. This approach ensures that rewards are based on platform performance, not speculative token emissions.

As fee revenue surpasses token incentives, DeFi protocols are beginning to function more like self-sustaining businesses. The move aligns economic incentives with long-term utility and offers more predictable returns, especially appealing to institutional participants.

🧠 Why This Signals Maturity in DeFi

The fee-first shift is more than a payout change—it’s a sign that DeFi is growing up. By focusing on protocol sustainability, platforms can withstand market volatility while building lasting value for users and investors.

With less dependence on volatile tokens, platforms with reliable fee structures attract long-term capital and foster reduced speculative behavior. This helps eliminate reliance on token inflation and instead encourages the development of robust ecosystems.

Online advertising service 1lx.online

💼 DeFi’s Future: Interoperability, Institutions & Innovation

As fee-based models take center stage, DeFi is also seeing technological and governance innovation. Protocols are enhancing UX, activating fee switches, and expanding cross-chain interoperability—notably via Cosmos and Polkadot—to streamline liquidity and attract diverse capital.

At the same time, institutional interest in DeFi is accelerating. Traditional finance firms are exploring partnerships, lured by the transparency, performance-based returns, and now, fee-driven reliability DeFi offers.

However, growing attention brings regulatory pressure. Platforms must navigate compliance frameworks without compromising decentralization.

In summary, the shift toward fee-based rewards is more than just a payout realignment—it represents a structural evolution. DeFi is maturing into a more resilient, investor-friendly ecosystem, no longer dependent on token hype but grounded in real, measurable performance.

Online advertising service 1lx.online

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)