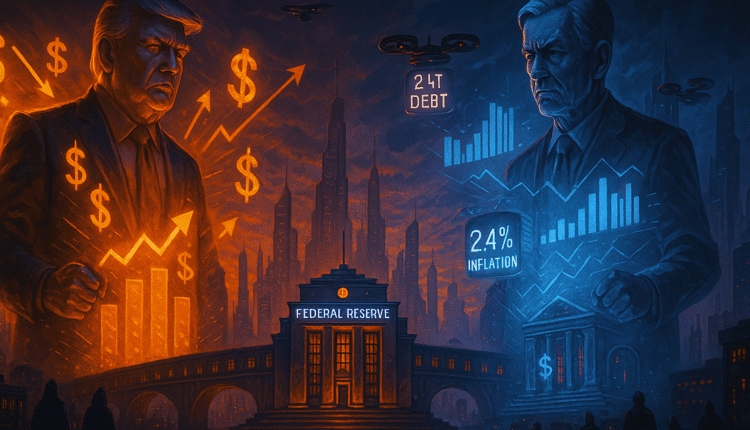

Trump Challenges Powell Fed Control, Says He Knows More About Rates Amid 2025 Inflation Rift

President Trump reignites tension with Fed Chair Powell, claiming greater knowledge of interest rates as tariff tensions and inflation reshape America economic trajectory.

President Donald Trump launched another scathing critique of Federal Reserve Chairman Jerome Powell during his rally in Michigan on April 29, 2025. In a dramatic declaration, Trump stated, “I know much more about interest rates than Powell does.” This public rebuke, delivered to a receptive crowd, marked a renewed escalation in the ongoing feud between the White House and the U.S. central bank.

Trump vs. Powell: The Economic Power Struggle

Online advertising service 1lx.online

Trump’s dissatisfaction with Powell has been growing for months. Just weeks ago, on April 17, he controversially floated the idea of firing Powell for the Fed’s hesitation in slashing rates. While Trump later walked back his intentions, the rally remarks suggest he remains committed to publicly undermining Powell’s credibility.

Central to Trump’s frustration is the Fed’s reluctance to ease monetary policy in response to his aggressive trade agenda. The Federal Reserve has kept interest rates steady throughout 2025, citing persistent inflation (currently 2.4%) and modest growth expectations.

Trump’s Argument: Tariffs Demand Lower Rates

In Trump’s view, the Fed is stifling economic momentum at a critical juncture. His administration’s renewed tariffs, aimed at boosting domestic manufacturing and shielding American jobs, are increasing cost pressures. Trump insists the Fed should counterbalance that with rate cuts to support growth.

“The Fed would be MUCH better off CUTTING RATES as U.S. Tariffs start to transition,” Trump wrote in a March post on Truth Social, aligning his pro-tariff policy with a dovish monetary outlook. His rhetoric appeals to working-class voters in manufacturing states, but it raises red flags for central bankers prioritizing inflation control over politics.

Powell Stays the Course

Chairman Powell, speaking in Chicago last week, reaffirmed the Fed’s independence and its data-driven approach. He emphasized that a 2.4% inflation rate still exceeds the central bank’s 2% target and that further caution is warranted before easing monetary policy.

Despite mounting political pressure, Powell has insisted the Fed will not respond to “external noise.”

Online advertising service 1lx.online

Independence Under Threat?

This standoff has ignited concern among economists and financial analysts over the Fed’s autonomy. The central bank’s credibility relies heavily on its insulation from short-term political whims. Trump’s remarks, especially his self-asserted monetary expertise, risk undermining that foundational principle.

Markets responded with unease. On April 21, the Dow Jones Industrial Average shed nearly 1,000 points, reacting to the dual uncertainty of monetary policy and Trump’s tariff escalation. Though partial recovery came by April 23, volatility remains high.

Voter Sentiment and Economic Anxiety

The political divide over monetary policy is also mirrored in consumer sentiment. A recent Pew Research poll (April 23) showed that fewer than half of Americans approve of Trump’s handling of the economy. Additionally, 90% of respondents expect inflation to rise due to tariffs, further intensifying household financial concerns.

Online advertising service 1lx.online

With 2025 shaping up as a defining year for the U.S. economy, Trump’s continued attacks on the Fed could fuel further volatility—both in the markets and in public trust.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)