Solana Revenues Plunge 93% from January Peak as Trading Activity Slows

Solana revenues have fallen 93% from their January peak, with trading volume and meme token activity declining. With lower DeFi engagement and bot activity, can Solana sustain its dominance?

Solana Faces Revenue Decline Amid Falling Trading Volumes

Solana (SOL) is experiencing a significant revenue drop, falling 93% from its January peak. The decline comes as meme token hype fades, leading to a slowdown in DEX activity and token trading.

Online advertising service 1lx.online

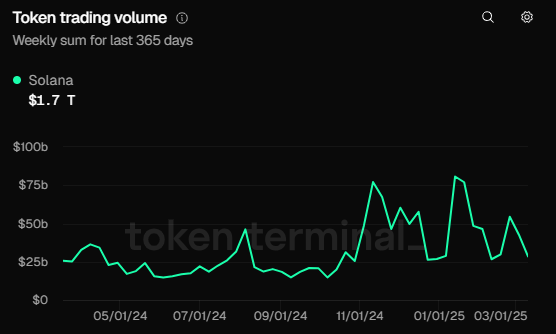

At its peak, Solana weekly meme trading volume exceeded $80 billion, but by March, that number had plunged to $28 billion, according to TokenTerminal data. The downturn has affected major Solana-based apps, including Jito, Pump.fun, and Jupiter DEX, which have lost ground compared to competitors on other blockchains.

Declining Fees and User Activity Weigh on Solana’s Ecosystem

The Solana ecosystem has seen a sharp decline in network fees, falling to $6.4 million per week, down from a peak of $89 million. The loss in on-chain activity has put pressure on SOL’s market price, which recently traded at $130.56 after a brief recovery.

Most Solana wallets hold less than 1 SOL, with the largest cluster between 10-100 SOL. Only 4,971 wallets hold over 10,000 SOL, demonstrating how whale trading has dominated recent price action.

The drop in token-based activity has also impacted MEV bot builder JitoSOL and Jupiter DEX, both of which were instrumental in Solana’s peak on-chain GDP growth during the bull cycle.

Meme Token Crash Contributes to Revenue Decline

Solana’s strongest earnings period was from November 2024 to January 15, 2025, when its DeFi protocols generated over $751 million in revenues. However, revenues crashed in January due to a wave of scam tokens and rug pulls, particularly following the launch of Trump (TRUMP), MELANIA, and LIBRA tokens.

Solana’s total value locked (TVL) peaked on January 23 at over $11 billion, before declining to $6.96 billion in March. While $12.34 billion in stablecoin liquidity remains, largely from new USDC printing, overall DeFi activity has slowed significantly.

Online advertising service 1lx.online

Solana Trading Bots Exit, Reducing Market Activity

Solana’s high-frequency trading was previously dominated by bots, which accounted for up to 86% of all transactions. However, bot activity has now dropped to 80%, with some of it shifting to Base and BNB Chain (5% each) and Ethereum (7%).

Pump.fun, once a major driver of Solana’s trading volume, has seen its daily token launches fall to 25,000, with revenues dropping to $1 million or less. Fewer tokens are transitioning from Pump.fun to Raydium, further reducing the demand for trading bots.

What’s Next for Solana?

Despite the decline in on-chain activity and trading fees, Solana remains a dominant chain for meme trades and new token launches. However, without a revival in user activity, DeFi engagement, and major trading incentives, its current downturn could persist.

Online advertising service 1lx.online

With alternative blockchains gaining traction, Solana’s future may depend on attracting new projects, maintaining liquidity, and stabilizing trading demand.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)