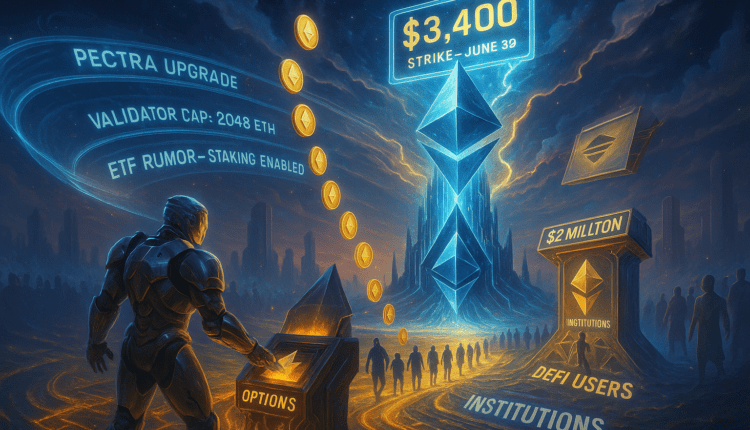

Trader Bets $2M on ETH Soaring Past $3.4K by June-End After Pectra Upgrade

A high-stakes ETH call option play is sending bullish waves through the market. With Ethereum’s Pectra upgrade complete and ETF rumors swirling, one trader is betting big on a 30% surge by June’s end.

In a bold move that has reignited bullish sentiment, a prominent trader has wagered over $2 million on Ethereum’s price rising dramatically above $3,200–$3,400 by the end of June. According to Deribit data, the trader acquired 61,000 call option contracts at those strike levels, signaling a strong belief in a rally exceeding 30% from current levels near $2,460.

These contracts grant the right—though not the obligation—to purchase ETH at the specified prices before expiry. This $2 million premium is the trader’s maximum potential loss, underlining a calculated risk with asymmetric upside.

Online advertising service 1lx.online

The move comes in the wake of Ethereum’s recent Pectra upgrade, which is viewed by analysts as a foundational shift in the network’s scalability and staking infrastructure. The upgrade, implemented on May 7, introduced enhancements like EIP-7702, which enables regular wallets to utilize smart contract features, and increased the validator cap from 32 ETH to 2,048 ETH. Additionally, blob throughput has doubled, optimizing the blockchain’s Layer-2 efficiency.

Dr. Youwei Yang, Chief Economist at BIT Mining, emphasized in a recent CoinDesk interview that Pectra “marks a turning point” for Ethereum’s evolution. “By reinforcing the network’s infrastructure, Ethereum is attracting renewed developer interest, fresh user activity, and growing capital,” Yang noted.

The bullish tone isn’t limited to traders. SharpLink Gaming recently announced plans to allocate $425 million to Ethereum as part of its treasury reserve, echoing the early corporate BTC accumulation trends.

Speculation is also intensifying around the possible approval of a spot Ether ETF with staking mechanisms, a product that could differentiate ETH from Bitcoin in institutional portfolios by offering exposure to both price appreciation and yield—a major missing piece in current BTC-based ETFs.

With institutional momentum, technical tailwinds, and rising on-chain activity, Ethereum appears to be regaining its edge—and if this latest multi-million dollar bet proves prescient, ETH could be preparing for liftoff.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)

I’m often to blogging and i really appreciate your content. The article has actually peaks my interest. I’m going to bookmark your web site and maintain checking for brand spanking new information.