SEC Greenlights PoW Mining: Legal Clarity Sparks Altcoin Rally, Calms Bitcoin Miners

The SEC has clarified that Proof-of-Work mining isn’t a securities violation, boosting miner confidence and investor interest in emerging PoW coins.

The U.S. Securities and Exchange Commission (SEC) has officially confirmed that Proof-of-Work (PoW) mining does not fall under securities regulation, delivering long-awaited legal clarity for miners and investors in the crypto space. This statement covers major PoW-based cryptocurrencies such as Bitcoin (BTC), Litecoin (LTC), and Bitcoin Cash (BCH)—providing assurance that mining these assets does not equate to issuing or trading unregistered securities.

This declaration is a game-changer for the mining sector. For years, the industry has operated in a gray area, unsure whether regulators would target PoW operations. Now, with a formal nod from the SEC, miners can scale operations without fear of enforcement, legal ambiguity, or burdensome compliance requirements tied to securities laws.

Online advertising service 1lx.online

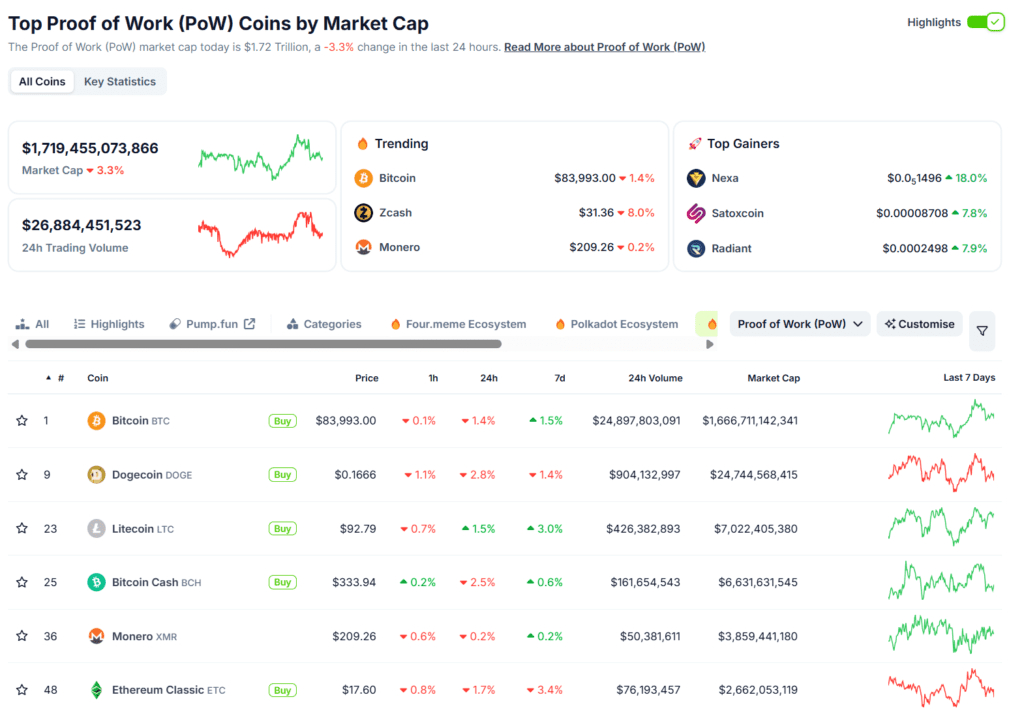

The impact? Confidence. And it’s being felt not just among miners, but investors too. The news catalyzed a shift in market behavior. Interestingly, major PoW assets such as Bitcoin and Dogecoin dipped slightly following the announcement, possibly reflecting a broader market cooldown. Bitcoin fell 1.4% to $83,993, Dogecoin slid 2.8% to $0.1666, and Bitcoin Cash dropped 2.5% to $333.94.

But the real story? Smaller PoW altcoins took off.

- Nexa jumped 18% to $0.00514

- SatoXcoin rallied 7.8%

- Radiant gained 7.9%

This suggests that investors are reallocating capital into lesser-known PoW projects, now emboldened by regulatory certainty and growth potential. The performance divide also implies that while major assets are being consolidated, fresh interest is flowing into the next generation of PoW tokens.

This announcement aligns with the SEC’s broader trend toward regulatory clarity over regulation by enforcement. In addition to this ruling, the SEC recently ended its lengthy lawsuit with Ripple and clarified that meme coins like Dogecoin don’t meet the definition of securities either.

The agency’s latest moves appear to be forming a clearer, more structured framework for the U.S. crypto industry. Such consistency is especially valuable amid a global regulatory landscape that’s still catching up.

What does this mean going forward?

For miners, this is a green light to build with fewer legal risks. For investors, it unlocks new opportunities in emerging PoW ecosystems, where innovation and high-reward speculation thrive. And for regulators, it’s a strategic pivot that signals a shift from confrontation to cooperation.

Online advertising service 1lx.online

While larger PoW coins may be experiencing short-term price corrections, the regulatory clarity acts as a bullish catalyst for long-term sentiment—especially for the sector’s infrastructure builders and early-stage projects.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)