Bitcoin at a Crossroads: Will Weak Inflows Push BTC Toward $46K or Spark an April Recovery?

Bitcoin shows reduced volatility and weakening inflows, triggering fears of a deeper correction. Analysts warn of a possible drop to $46K while others point to liquidity growth as a bullish sign.

Bitcoin’s Price Faces Uncertainty Amid Signs of a Potential Market Shift

Bitcoin (BTC) continues to exhibit muted price action, gaining only 0.23% over the past 24 hours. The asset’s low volatility and fading market excitement are signaling indecision, leaving traders on edge as BTC hovers near key technical thresholds.

Online advertising service 1lx.online

With market participants split between bearish caution and long-term optimism, on-chain and macro indicators are beginning to paint a clearer picture of Bitcoin’s evolving trend.

Is Bitcoin Losing Its Momentum?

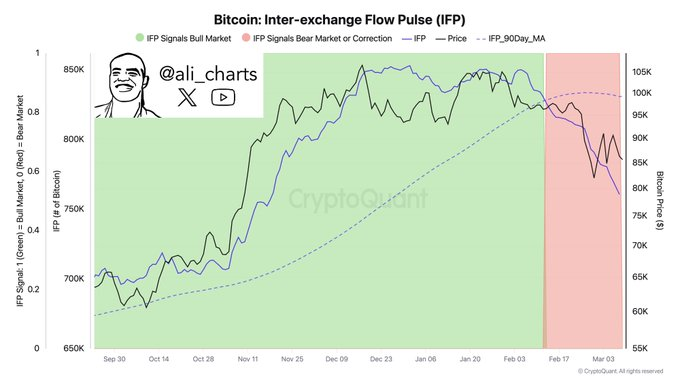

Renowned market analyst Ali Martinez has highlighted signals pointing to a significant change in Bitcoin’s long-term direction. The Inter-Exchange Flow Pulse — an indicator tracking capital movements between trading platforms — suggests that Bitcoin may be entering a correction phase.

Further supporting this theory is the MVRV Ratio, which historically precedes market corrections. According to Martinez, this metric now echoes past instances of major downturns in Bitcoin’s price.

The recent behavior of large holders seems to confirm the shift. Bitcoin whales have reportedly withdrawn over $260 million from their holdings in March alone, while miners have cashed out $27 million in profits. This withdrawal trend indicates rising caution and a potential drop in market confidence.

Capital Inflows Plummet: A Bearish Signal?

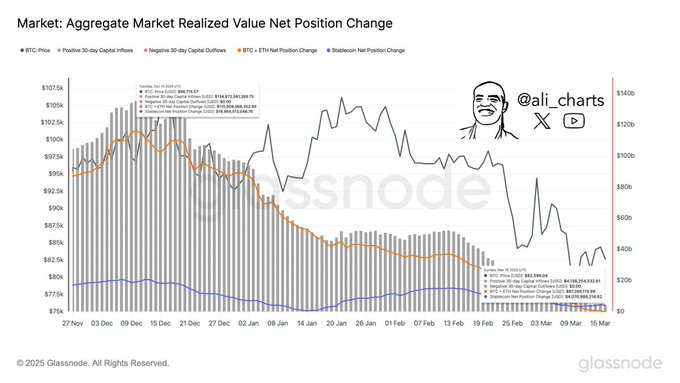

Glassnode data shows a startling decline in Bitcoin’s capital inflows — from $135 billion in December 2024 to just $4 billion this month. These levels were last seen in October 2023, a period marked by lackluster market performance.

Online advertising service 1lx.online

This massive pullback in capital has triggered concern among analysts. Martinez has identified a major support zone between $66,000 and $69,000 — levels where nearly 313,000 BTC were acquired by around 750,000 investors. Losing this range could result in deeper losses for BTC.

Both the UTXO Realized Price Distribution and the Mayer Multiple suggest $69,354 and $66,000, respectively, as crucial support points. Any breakdown beneath these thresholds could validate bearish momentum.

Could Bitcoin Collapse to $46K?

Martinez warns that BTC risks falling back to the 200-week simple moving average — a key historical support level currently sitting around $46,000. Every instance in the past decade where Bitcoin broke below the 50-week SMA led to a drop to this lower moving average.

If bearish pressure persists and support zones are breached, a move toward $46,000 could materialize — a sobering 40% drop from current levels.

Online advertising service 1lx.online

Is There a Silver Lining for BTC Bulls?

While bears point to technical weaknesses and capital outflows, a parallel narrative is gaining traction. Analysts such as Charles Edwards from Capriole Investments highlight a stabilizing U.S. liquidity environment, which often correlates with recoveries in risk assets, including Bitcoin.

Martinez echoes this sentiment, suggesting that global liquidity injections — often precursors to crypto rallies — could boost BTC prices by mid-April. This may set the stage for a rebound, particularly if liquidity trends align with past market cycles.

Conclusion: Correction or Comeback?

The battle between weakening technicals and improving macro liquidity sets the stage for a pivotal month for Bitcoin. Whether BTC retests $46,000 or reclaims bullish momentum in April will depend on capital inflows, liquidity shifts, and investor sentiment over the coming weeks.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)