Trump Tariffs Didn Break Trade — But Stablecoins and Bitcoin Are Winning the Monetary War

Frank Holmes says tariffs didn’t disrupt global trade — instead, money printing, stablecoin demand, and the global push for self-custody are powering crypto adoption worldwide.

According to U.S. Global Investors CEO Frank Holmes, former President Donald Trump’s aggressive tariff approach didn’t derail global trade as many feared. In an interview with TheStreet Roundtable, Holmes noted that despite loud political rhetoric, the core economic strategy stayed intact — and the real driver of financial disruption lies elsewhere.

“I don’t think the overall trade around the world backfired,” Holmes explained. While Trump’s tone had to shift — especially toward allies like Canada — global commerce remained largely functional. Holmes emphasized that while the U.S. sought economic leverage, China simultaneously built strategic financial bridges elsewhere, offering billions in credit and positioning itself as an alternative global partner.

Online advertising service 1lx.online

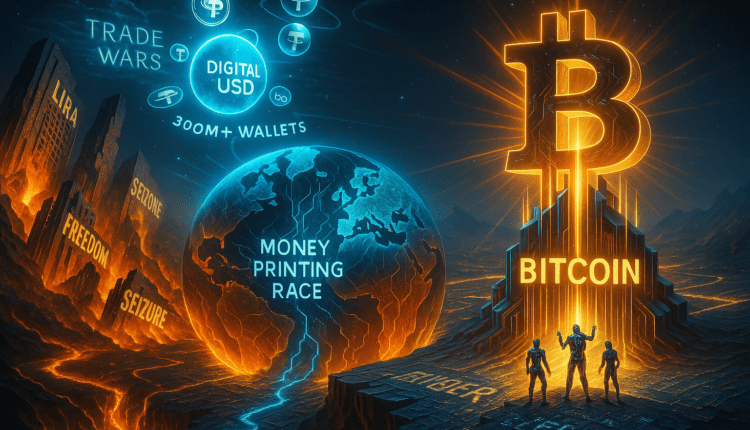

But Holmes says the real conflict isn’t about tariffs or diplomacy — it’s a deeper, systemic race: the global competition in currency devaluation through money printing.

In that race, Bitcoin and stablecoins are emerging as the true beneficiaries. Holmes pointed out that traditional fiat currencies are under mounting pressure, with Turkey’s Lira hitting all-time lows and Zimbabwe’s repeated currency collapses still fresh in memory. “Those who are Bitcoin holders have done exceptionally well,” he said, pointing to cryptocurrency’s performance as a hedge against inflation and government overreach.

One major theme Holmes returned to was the explosive rise of stablecoins — especially Tether. Now reportedly integrated into over 300 million wallets worldwide, Tether is filling a growing demand for dollar exposure without relying on domestic banking systems.

In parts of Latin America, Africa, and Eastern Europe, where governments have confiscated physical U.S. dollars, stablecoins offer citizens a lifeline. “Tether only buys U.S. dollars in their stablecoin. It tells you that the people want to have that U.S. dollar,” Holmes said.

Holmes also warned of the dangers of relying too heavily on custodians or centralized exchanges. He championed Bitcoin’s ability to be stored in segregated wallets, outside of the grasp of authoritarian regimes. “The ability to have access to your cash or your gold or your Bitcoin — outside of the clutches of bad governments — that’s what the whole world wrestles with,” he concluded.

As the geopolitical stage continues to shift and monetary policies grow more unpredictable, Holmes suggests that crypto’s true strength lies in giving people the freedom to control their own financial destinies — not just speculative gains.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)