Bitcoin Options Expiry: Will $1.4B in Contracts Influence Crypto Markets?

Bitcoin options worth $1.4 billion expire today, raising questions about their potential impact on market movements. The outcome could affect Bitcoin price, with Ethereum options also expiring

Friday has come around again, and that means Bitcoin options expiry day. Today, a significant $1.4 billion in Bitcoin options contracts are set to expire, leading to speculation about their potential influence on the spot market.

This week, the crypto markets have largely retained their gains, supported by Ethereum and the US Securities and Exchange Commission’s approval of spot exchange-traded funds. However, the expiry of these Bitcoin options on May 24 could introduce new dynamics.

Online advertising service 1lx.online

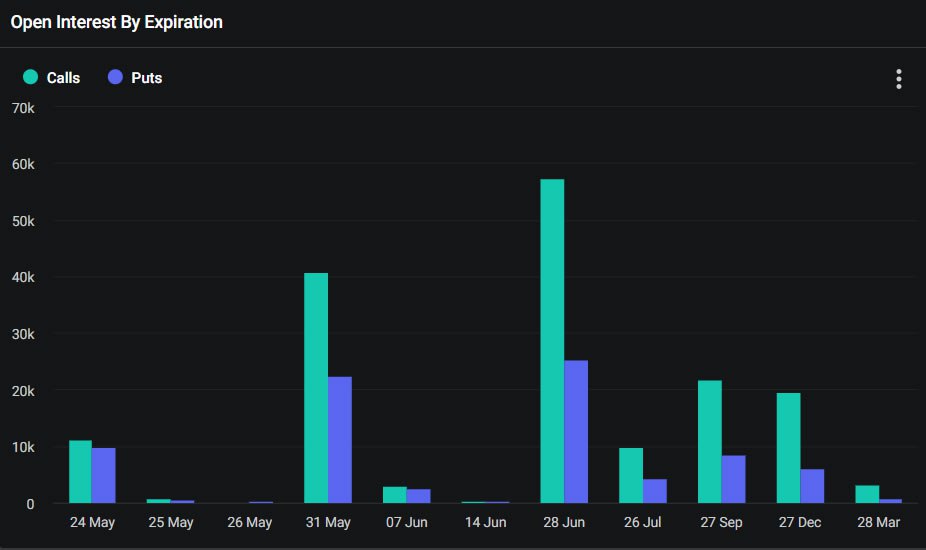

Approximately 21,000 Bitcoin contracts are expiring today. While this is a substantial figure, it pales in comparison to the month-end expiry on May 31, which will see a staggering $4.3 billion worth of options contracts come to an end, according to data from Deribit.

Bitcoin Options Expiry

For this week’s Bitcoin options contracts, the put/call ratio stands at 0.88. This indicates that the market is relatively balanced between long and short positions, with a slight tilt towards more calls expiring. The max pain point, or the price at which most option contract buyers lose their premium, is set at $67,000.

Long positions dominate the open interest (OI), with around $830 million at the $70,000 strike price. Higher strike prices also show significant OI, with approximately $843 million at the $100,000 level, according to Deribit.

Conversely, the $60,000 strike price holds the highest OI for put contracts, totaling $388 million. Open interest reflects the number or value of contracts that have yet to be settled, suggesting that bulls are optimistic about higher Bitcoin prices.

In addition to today’s Bitcoin options, around 354,000 Ethereum contracts are also expiring, with a notional value of $1.5 billion. The put/call ratio for these Ethereum contracts is 0.57, indicating more calls expiring than puts.

Derivatives traders have been actively speculating on Ethereum, particularly in the lead-up to the SEC’s decision. There is around $515 million in OI at the $4,000 strike price, indicating bullish expectations for further momentum.

BTC pulled back as expected, compared to the very strong support for ETH’s price, with ETH’s current weekly weighted IV still exceeding 100%, while BTC’s current weekly IV is only 50%,” commented crypto derivatives software provider Greeks Live.

Crypto Market Impact

Online advertising service 1lx.online

With nearly $3 billion in Bitcoin and Ethereum options expiring today, the immediate impact on spot markets is typically muted. Total market capitalization has dipped slightly by 1.3% to $2.68 trillion, mainly due to a 2.3% decline in Bitcoin prices, which fell to $67,400 at the time of writing.

Ethereum, after experiencing significant volatility ahead of the SEC’s decision, is currently stable at $3,730.

Among altcoins, the market has shown mixed results. Chainlink (LINK), PEPE, and Ethereum Classic (ETC) have seen gains, while Solana (SOL), Dogecoin (DOGE), and Toncoin (TON) have experienced losses.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)