Bitcoin Miners Face Lowest Revenue of 2024 in August as Whale Accumulation Increases

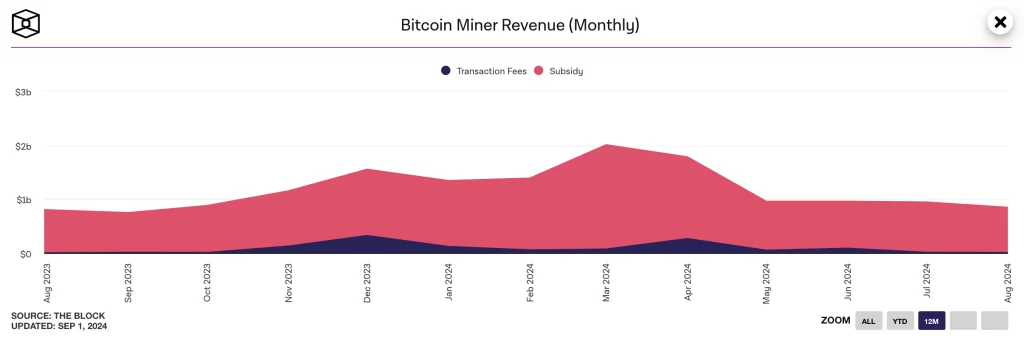

Bitcoin mining revenue dropped to its lowest point in 2024, reaching $851 million in August, a $99.75 million decrease from July. Despite this, Bitcoin whales have increased their holdings, hitting a 17-month high.

Bitcoin miners experienced their least profitable month of 2024 in August, with total revenue dropping to $851 million. This marks a significant decline of $99.75 million compared to July, according to data from The Block.

August Sees a Dip in Bitcoin Mining Revenue

Online advertising service 1lx.online

The month of August proved to be challenging for Bitcoin miners as revenue fell to the lowest levels recorded this year. In contrast to the $951 million generated in July, August saw a drop of $99.75 million in total mining revenue.

Interestingly, $20.76 million of this revenue came from on-chain fees, with 4,289 blocks mined throughout the month. However, the fees collected were $4.14 million less than those in July. Among the miners, Foundry USA led the way by mining 1,248 blocks, accounting for 29.10% of the total, while Antpool followed with 1,074 blocks, representing 25.04% of the total blocks mined.

The reduction in revenue is partly attributed to the effects of the Bitcoin Halving event, which has intensified competition among large mining companies, leading to tighter profit margins.

Whale Accumulation Increases Amid Mining Revenue Decline

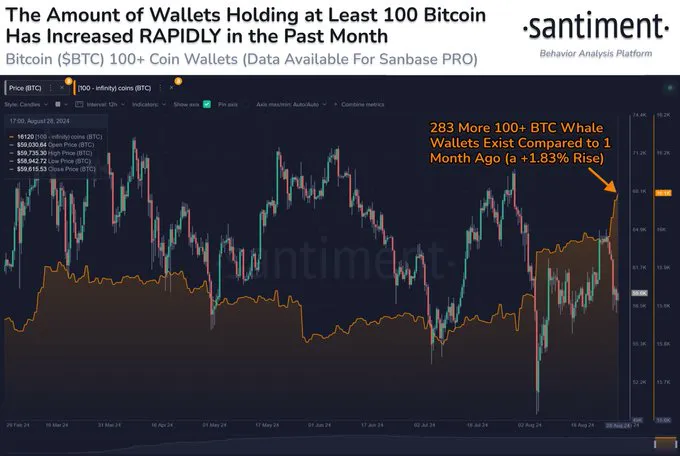

Despite the slump in mining profits, Bitcoin whales have been steadily increasing their holdings. Data from Santiment reveals that the number of wallets holding at least 100 BTC surged by 283 in August, bringing the total number of such wallets to 16,120, a 17-month high. Additionally, wallets holding at least 10 Bitcoin also saw an increase during this period.

This accumulation by whales comes at a time when Bitcoin’s price has been struggling. Over the past seven days, Bitcoin has lost over 10% of its value, trading in a range between $57,383.55 and $64,066.22. The ongoing volatility has made it difficult for Bitcoin to maintain its $60,000 support level. However, the recent dip is being viewed as a buying opportunity by whales, who are capitalizing on the lower prices to accumulate more coins.

Conclusion

Online advertising service 1lx.online

While Bitcoin miners are facing significant challenges with declining revenue, large-scale investors are taking advantage of the market conditions to increase their Bitcoin holdings. The contrast between falling mining profits and rising whale activity highlights the complex dynamics currently at play in the cryptocurrency market.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)