Bitcoin Faces Critical Test at $95K Resistance as Bulls Eye Breakout

Bitcoin hovers near the $95K resistance, with rising leverage and key indicators hinting at a possible breakout—or a sharp correction if bulls fail to seize momentum.

April 26, 2025 – Bitcoin (BTC) is once again at a decisive crossroads. Despite recent bullish developments, the market now faces a critical hurdle: a confirmed breakout above the $95,783 resistance zone.

BTC’s MVRV ratio—an important mid-term indicator—recently hit 2.13, just shy of its historically significant 365-day Simple Moving Average (SMA365) at 2.14. This level has often marked the tipping point between bearish consolidations and bullish recoveries.

Online advertising service 1lx.online

A decisive weekly close above the SMA365 could ignite a stronger rally. But failure could spell renewed selling pressure.

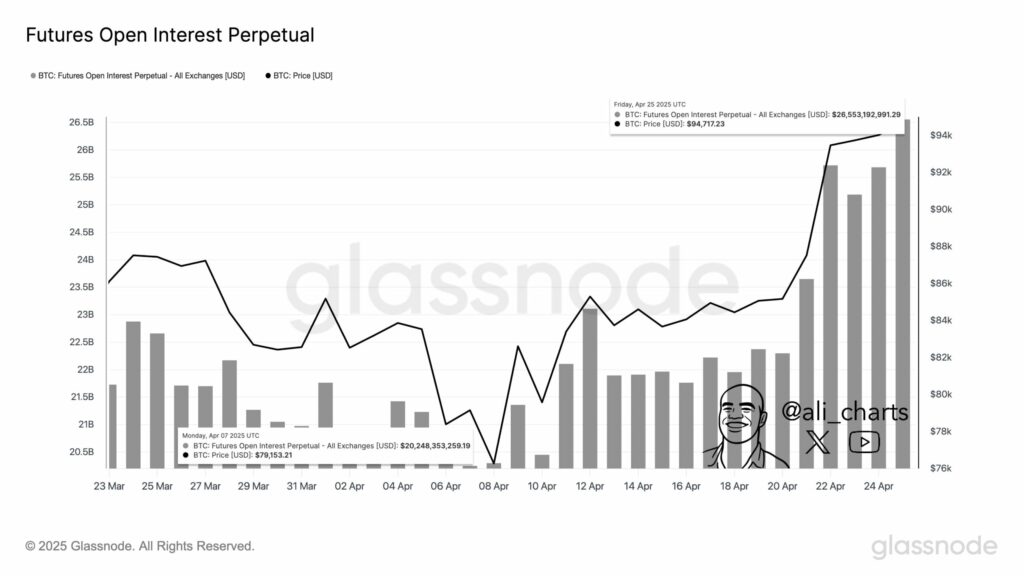

📈 Bitcoin Speculation Ramps Up

Fueling the volatility, Open Interest across Bitcoin futures markets has surged by 20% in the past 20 days, now exceeding $26 billion. Simultaneously, the Estimated Leverage Ratio has risen to 0.99%, indicating that traders are aggressively using margin to amplify their positions.

While increased leverage often foreshadows sharp short-term price moves, it also heightens the risk of liquidation cascades if sentiment shifts suddenly.

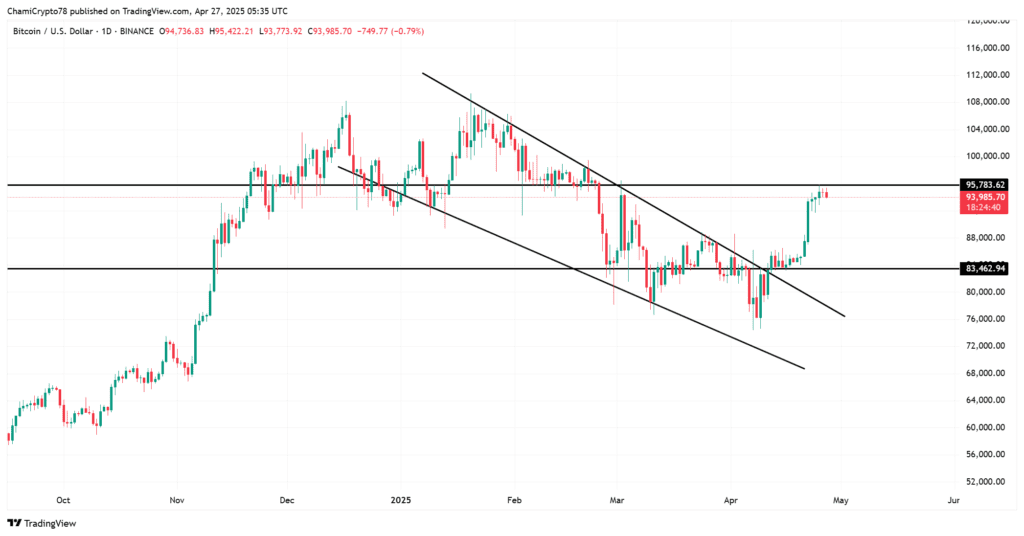

🔥 BTC Technical Price Action – Will Resistance Break?

Bitcoin recently broke out from a falling wedge formation—a traditionally bullish signal.

However, at the time of writing, BTC trades at $94,036, reflecting a modest 0.71% pullback over the past 24 hours. This highlights seller resilience around the critical $95,783 resistance.

Online advertising service 1lx.online

Without a strong daily close above this resistance, Bitcoin risks sliding back toward $83,462 support, where previous buying strength emerged.

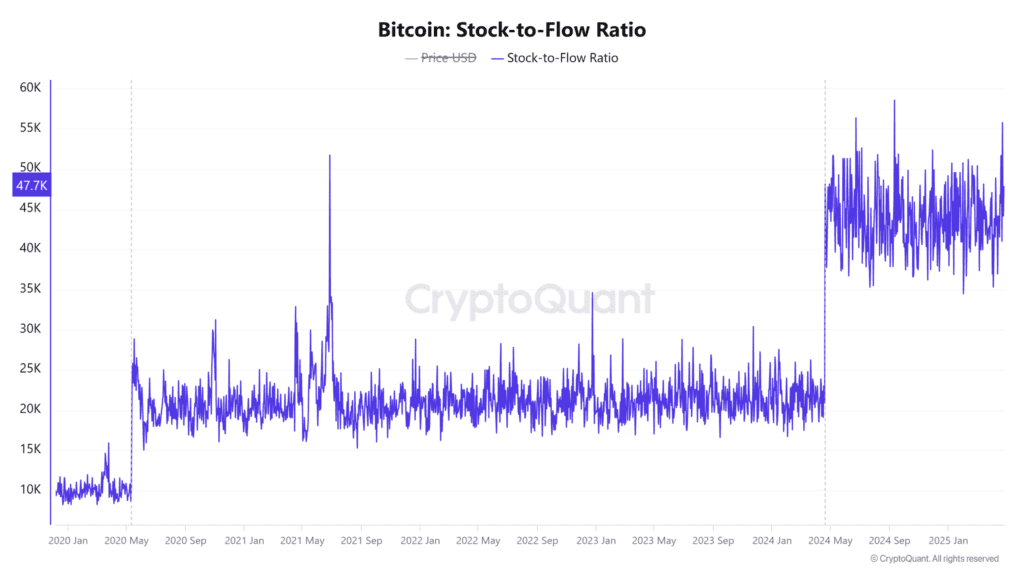

📉 Stock-to-Flow Model Faces Pressure

Bitcoin’s revered Stock-to-Flow (S2F) ratio—an indicator of scarcity—has dropped by 22.22%, suggesting short-term softening of the classic bullish model.

Nonetheless, the decline does not fundamentally alter Bitcoin’s long-term scarcity-driven value proposition. It simply underscores that liquidity conditions and leverage dynamics are currently the dominant short-term drivers.

Online advertising service 1lx.online

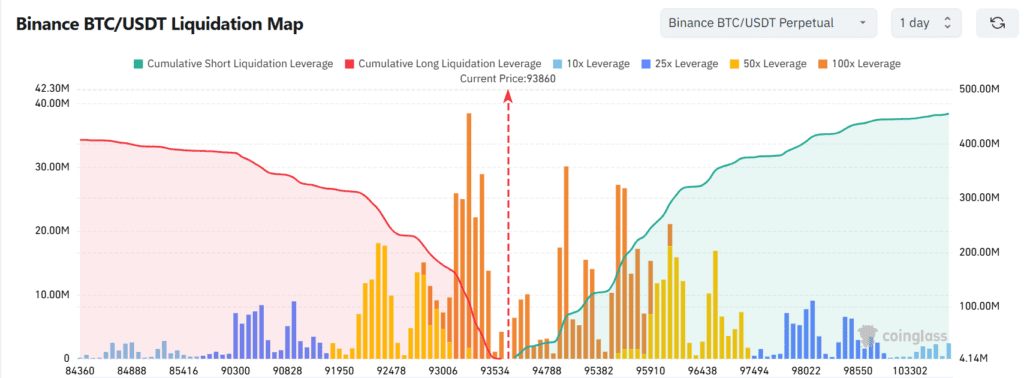

🗺️ Liquidation Map Insights – Next Moves for BTC

According to recent liquidation map analysis, Bitcoin faces dense long liquidation clusters between $93,000 and $94,000. This zone now acts as crucial support.

- A break below $93K could trigger a liquidation cascade, dragging BTC toward $91K.

- A break above $95,783 would encounter thin liquidation density, offering little resistance up to higher targets.

Thus, holding and flipping $95,783 into support is critical for bulls to unlock rapid upside movement.

🧠 Conclusion

Bitcoin stands at a pivotal decision point.

While bullish structures are forming—such as the MVRV nearing breakout, leverage buildup, and falling wedge breakout—only a confirmed push above $95,783 will validate the next aggressive rally phase.

Failure to do so could unleash sharp corrections toward lower liquidity regions. The next few daily closes will likely define Bitcoin’s trajectory for weeks to come.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)