Bitcoin Faces $102K Trap as Heatmaps Reveal Two-Sided Liquidation Setup

Bitcoin price action above $108K may be masking a dangerous setup. Analysts warn of a potential reversal to $102K driven by liquidity engineering and false breakouts.

Bitcoin (BTC/USD) appears stable above the $108,000 mark, but a deeper analysis of leverage and liquidation metrics suggests that the market may be preparing for a significant wipeout. According to new derivatives and on-chain data, the recent bullish surge could be a liquidity sweep rather than a true breakout, with signs pointing toward a looming decline to the $102,000 level.

Online advertising service 1lx.online

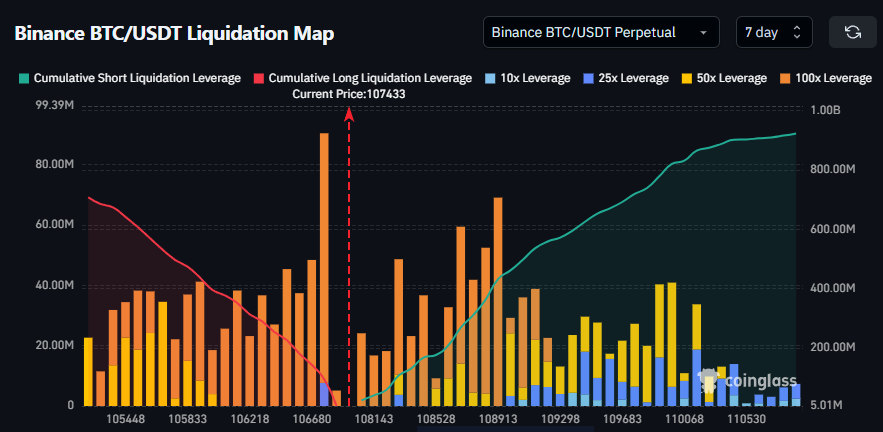

Analysts monitoring liquidation heatmaps have identified a dangerous setup: clusters of short liquidations are stacked between $108K and $110K, while long liquidations are heavily concentrated just below $102K. This pattern resembles what traders call a “liquidity sandwich,” where price is forced to both extremes to flush out leveraged positions.

The risk scenario? If Bitcoin first climbs above $109K, it could trigger a wave of short liquidations, creating a fake rally. Once that move exhausts itself, the market may swiftly reverse, punishing late long positions and cascading toward the $102K liquidation zone.

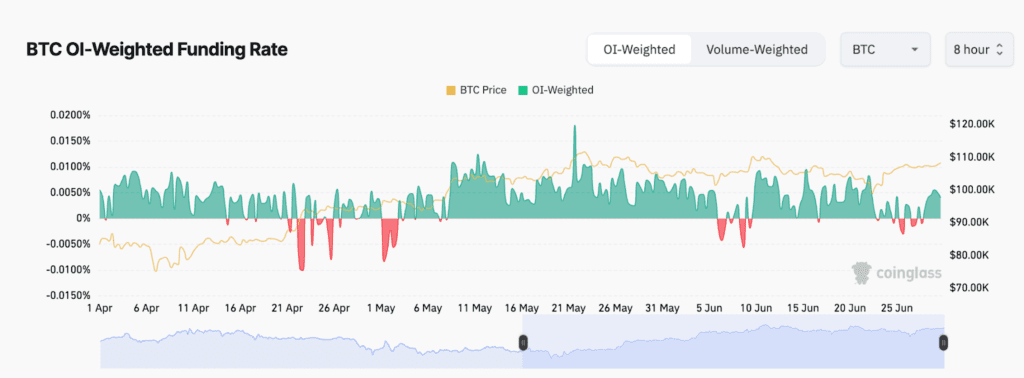

Compounding this concern is Bitcoin’s funding rate behavior. Although the OI-weighted funding rate has turned positive across major exchanges—a typically bullish signal—the context is troubling. Open interest hasn’t followed suit, meaning leverage is growing without momentum. Analysts refer to this as a “hope long” phase, where optimistic traders pile into longs without confirmation, only to be wiped out.

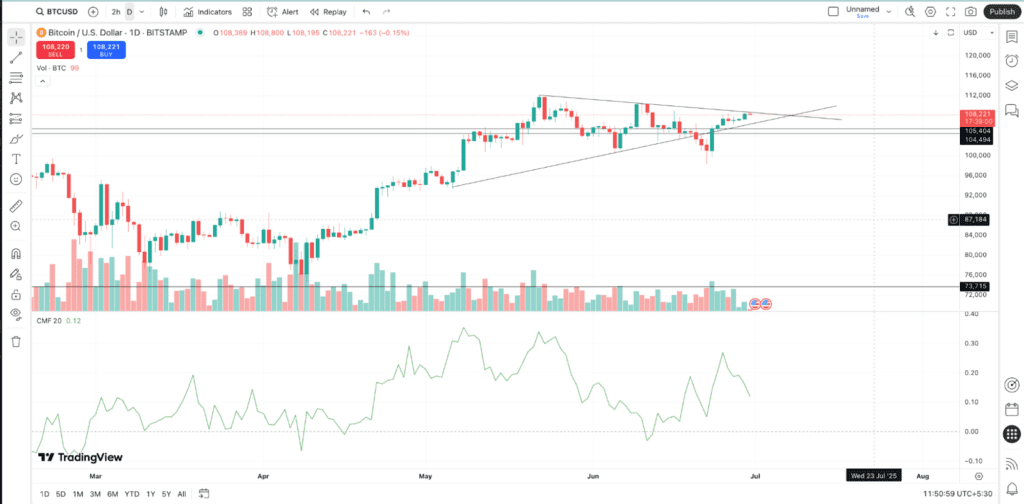

Adding to the skepticism is the flatline in the Chaikin Money Flow (CMF) indicator. Despite BTC touching $108K, CMF remains neutral, showing no significant influx of institutional capital. In a legitimate breakout, strong money flow would accompany the move. Its absence casts doubt on the breakout’s strength.

Instead of a bullish continuation, analysts see signs of a perfectly engineered trap: thin volume, rising leverage, weak inflows, and a vulnerable market structure.

If CMF fails to rise and Bitcoin price stalls near the wedge apex around $109K, there’s an elevated risk of a reversal that could send BTC spiraling down to the $102K cluster—a move that would liquidate a large cohort of hopeful traders and potentially reset market sentiment.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)

Online advertising service 1lx.online