Forgotten Fortune: Spanish Research Institute Rediscovers 97 BTC from 2012

On the island of Tenerife, a small research institute has stumbled upon a digital treasure chest — 97 Bitcoin (BTC) purchased in 2012 for roughly €10,000, now worth nearly €10 million. The discovery by Spain Institute of Technology and Renewable Energy (ITER) not only revives an old wallet but also symbolizes how deeply Bitcoin quiet adoption has penetrated unexpected corners of the institutional world.

🏝️ From Renewable Energy to Digital Gold: The 2012 Purchase

The purchase was reportedly made for a renewable energy experiment involving blockchain-based accounting for carbon offset credits. However, the project stalled, the wallet was forgotten, and for over a decade the coins remained untouched — lost in digital obscurity.

Online advertising service 1lx.online

As of early November 2025, the institute confirmed rediscovering access to the wallet and is now considering liquidating part or all of the holdings, which have appreciated more than 100,000% since acquisition.

“It’s one of those stories that makes you realize how early some non-financial entities truly were,” said a Spanish crypto researcher. “ITER was experimenting with blockchain before most exchanges even existed.”

🔑 Lost Wallet, Found Value

For years, the wallet remained inaccessible due to outdated private key storage.

Internal reports suggest the keys were held on old encrypted drives in ITER’s archive, only recently recovered during an audit of the institute’s IT systems.

After validation through blockchain explorers, staff confirmed the address still contained the original 97 BTC — untouched and traceable back to early block rewards.

The rediscovery triggered discussions between the Canary Islands government, which oversees the publicly funded institute, and local financial authorities on how to proceed with valuation, taxation, and liquidation.

At current prices, the holding represents one of the largest public-sector Bitcoin treasuries in Spain.

🧩 Why the Sale Now?

While ITER’s leadership has not finalized the sale, early reports suggest the institute plans to monetize part of the position to support renewable energy projects and infrastructure upgrades.

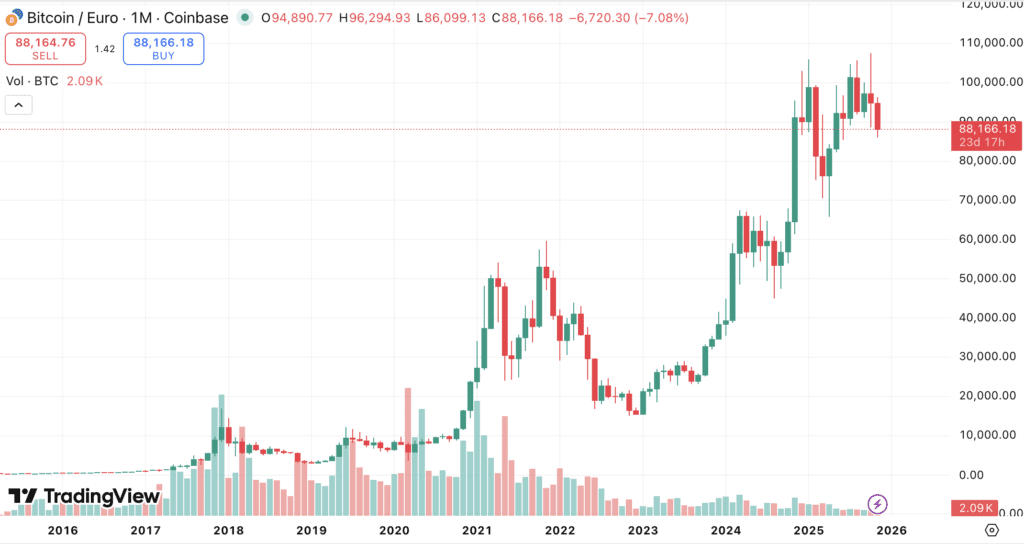

Selling now may also help avoid volatility risk, given Bitcoin’s recent pullback below $106,000.

Still, officials are reportedly debating how to sell transparently without affecting market price.

Options under discussion include:

Online advertising service 1lx.online

- OTC (over-the-counter) sale through a European digital asset broker

- Gradual liquidation through institutional-grade custody services

- Retaining a symbolic portion of BTC as part of the institute’s digital innovation fund

“This isn’t just about profit,” a spokesperson commented. “It’s about responsibly managing a legacy asset that accidentally became significant.”

🌍 Academic and Institutional Bitcoin Exposure

The ITER case adds to a growing list of non-financial or academic entities that hold legacy Bitcoin — either intentionally or through early experiments.

Universities and public research centers in the U.S., U.K., and Asia have occasionally revealed similar long-dormant holdings stemming from blockchain trials in the early 2010s.

Such cases reinforce Bitcoin’s global diffusion and highlight how even institutions outside finance inadvertently became part of the crypto revolution.

It also underscores the supply-shock narrative — many old coins are effectively “frozen,” reducing active supply and sustaining Bitcoin’s scarcity-driven value model.

Online advertising service 1lx.online

Cross-referenced with on-chain data from Glassnode, fewer than 2 million BTC have moved in the past five years — meaning roughly 90% of supply remains held or lost, an enduring feature of the asset’s digital resilience.

🧠 Implications: Tax, Transparency, and Precedent

The rediscovery raises fascinating policy and accounting questions:

- Taxation: As a public body, ITER’s gains may trigger complex state-level taxation.

- Transparency: Spain’s Ministry of Economy may require public disclosure of sale methods and beneficiaries.

- Precedent: Could this inspire other institutions to audit their digital holdings or reclaim lost experimental assets?

Financial analysts note that while ITER’s windfall won’t move markets directly, it reinforces the broader trend of institutional normalization of Bitcoin holdings — from corporate treasuries to state-backed organizations.

💡 Symbol of Bitcoin’s Journey

In a week dominated by ETF outflows and macro uncertainty, ITER’s rediscovered stash is a timely reminder of Bitcoin’s long arc of value creation.

What began as a €10,000 research expense has become a multi-million-euro asset — not through speculation, but through time, patience, and blockchain permanence.

“This story perfectly captures the Bitcoin paradox,” said analyst @CryptoKaleo. “An energy lab holding digital gold — the old world meeting the new.”

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)