Bitcoin Crashes to 4-Month Low—Will $75K Be the Next Target?

Bitcoin price fell to $76,811 before rebounding, pressured by institutional outflows, macroeconomic uncertainty, and technical weakness. Analysts warn BTC may test $75K if bearish momentum persists.

Bitcoin Price Drops to 4-Month Low as Macro Pressures Mount

Bitcoin’s price took a sharp dive on March 11, reaching a four-month low of $76,811 before rebounding near $79,500. The drop follows a broader market sell-off, with the S&P 500 and Nasdaq Composite Index declining 2% and 3.5%, respectively.

Online advertising service 1lx.online

Macroeconomic Instability and Reduced Government Spending Weigh on BTC

Traders attribute Bitcoin’s decline to concerns over reduced U.S. government spending and ongoing macroeconomic instability. The recent rally fueled by the U.S. Strategic Reserve announcement has now been completely erased, according to The Kobeissi Letter.

Adding to this, the Department of Government Efficiency (DOGE) has implemented spending cutbacks, weakening economic momentum and fueling risk-off sentiment in financial markets.

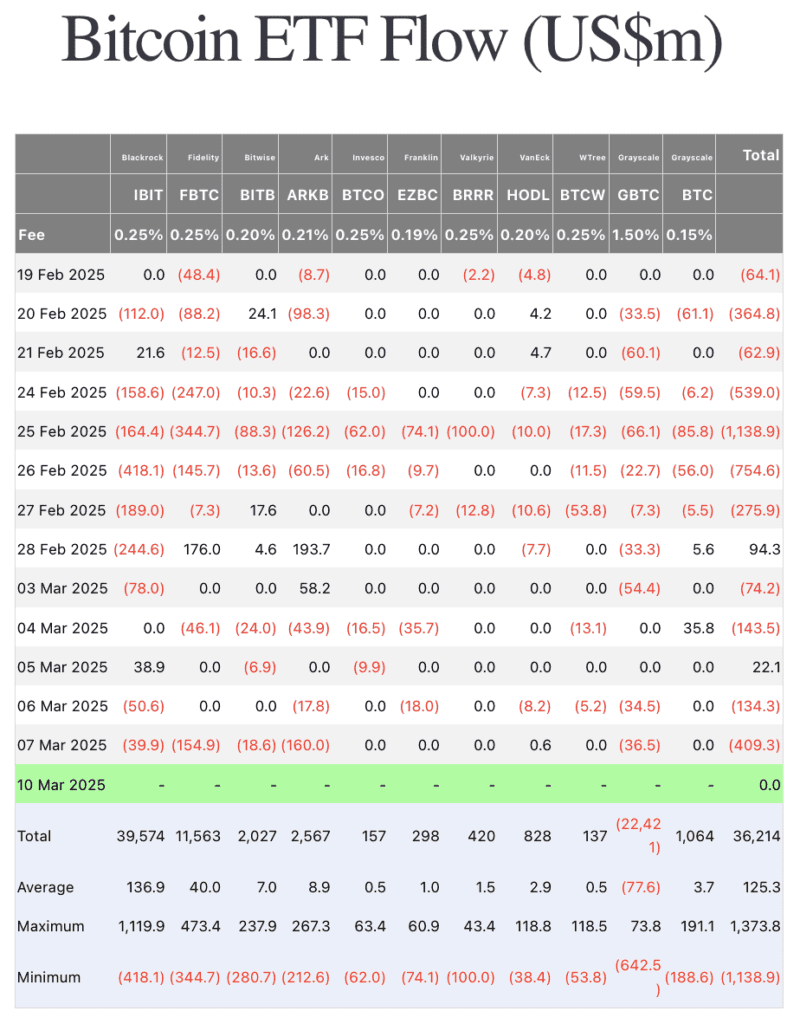

Institutional Outflows and ETF Weakness Add Pressure

Data from Farside Investors reveals a consistent decline in institutional interest, with U.S.-based Bitcoin ETFs experiencing consecutive days of negative net flows. Historically, institutional demand has played a key role in Bitcoin’s price stability.

Meanwhile, a report from Bitfinex Alpha highlights that over $3 billion in Bitcoin and Ethereum options expired last Friday, contributing to the recent market volatility.

Online advertising service 1lx.online

“Options realized volatility surged above 80%, signaling heightened instability as traders reacted to shifting macroeconomic conditions,” the report stated.

Bybit Hack Fallout and Its Impact on BTC’s Price

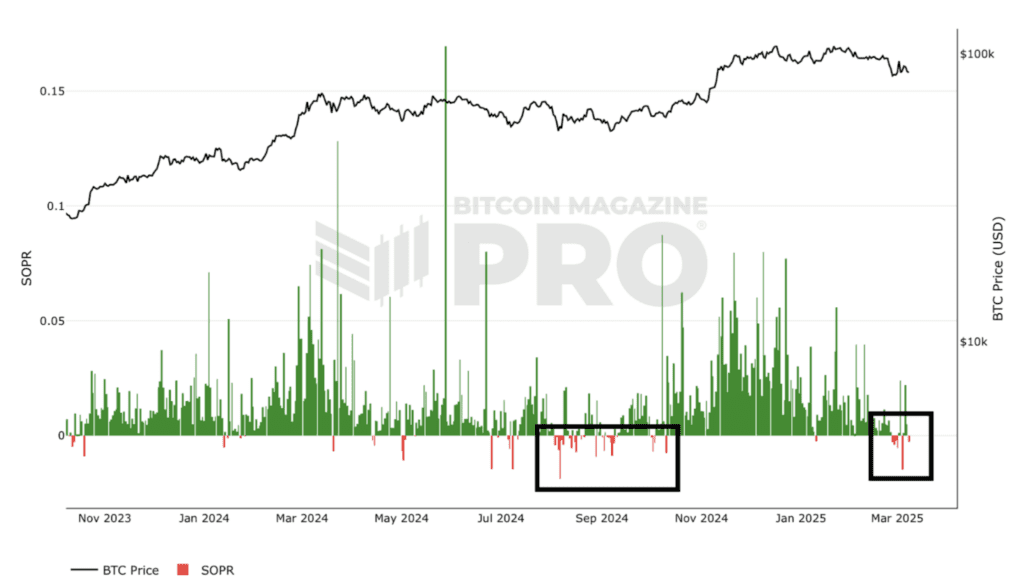

Security concerns have further dampened Bitcoin’s outlook, with the aftermath of the Bybit hack fueling additional sell-offs.

Analysts at QCP Capital noted that hackers are still actively offloading stolen assets, increasing downward pressure on BTC.

Online advertising service 1lx.online

“Today’s price selloff may also be exacerbated by holders front-running further hacker-driven supply,” QCP Capital explained in a Telegram update.

Hackers have already seen their stolen assets depreciate by 25%, leading to an aggressive cash-out strategy. Analysts caution that bearish sentiment could persist until at least Q3 2025, particularly given Bitcoin’s growing correlation with equities.

Crypto Fear & Greed Index Hits ‘Extreme Fear’

Investor sentiment has plummeted, with the Crypto Fear & Greed Index dropping to 20, marking a return to the ‘extreme fear’ zone. This is a steep decline from 27 just a day prior, signaling increasing risk aversion among traders.

Historical trends suggest that such extreme fear readings often precede market bottoms, though precise timing remains uncertain.

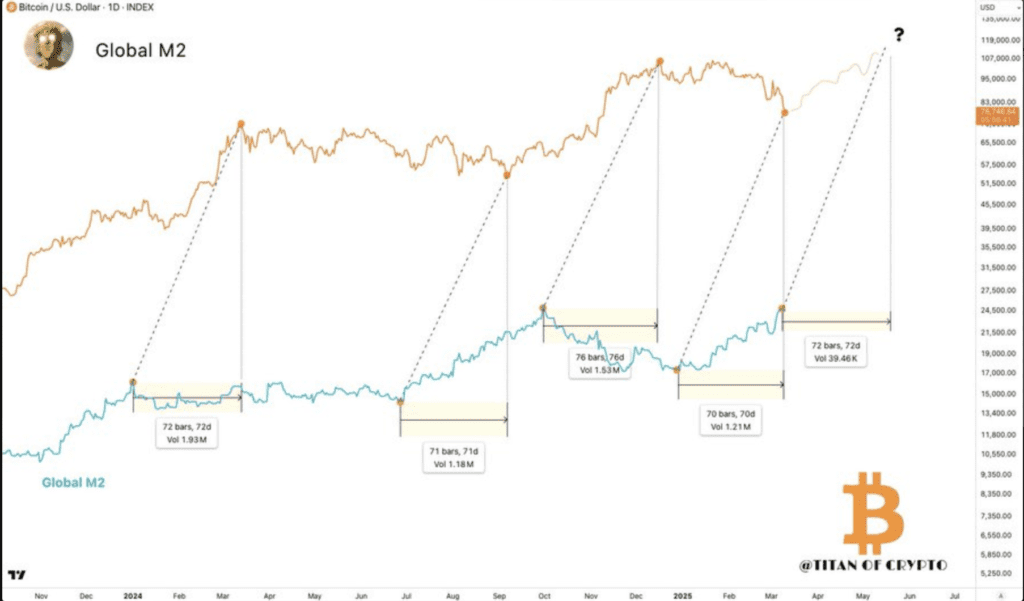

According to Titan of Crypto, Bitcoin’s price typically lags global monetary supply by 70 days, indicating that a potential recovery could materialize by May. However, for now, bearish momentum dominates.

Bitcoin Faces Technical Resistance—Is $75K Next?

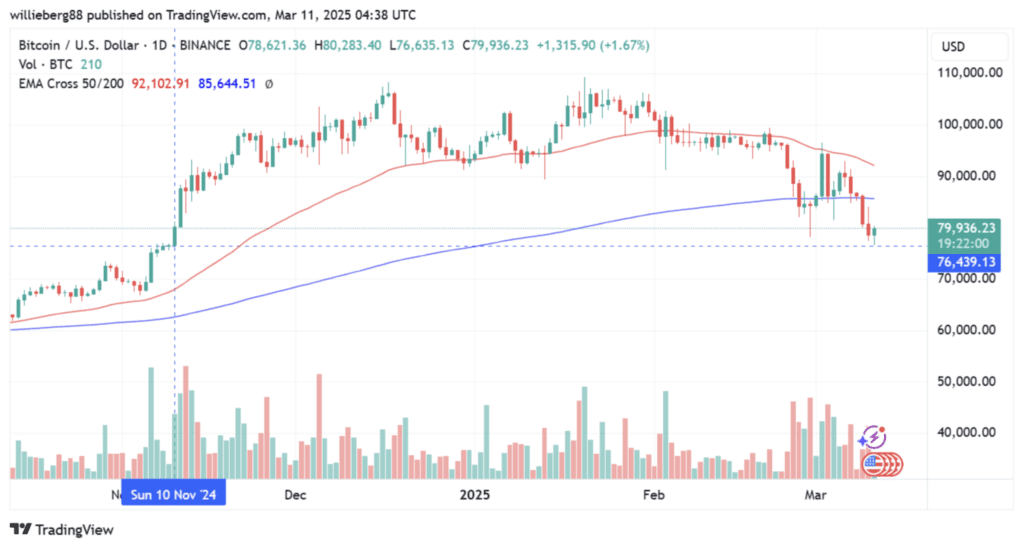

Bitcoin’s daily chart shows a descending channel, with BTC recently bouncing off the lower trendline near $76,800. The 200-day exponential moving average (EMA) sits at $85,645, while the 50-day EMA stands at $92,061—both acting as major resistance levels.

Additionally, Fibonacci retracement levels pinpoint $91,828 as the 50% retracement level of Bitcoin’s previous rally. If BTC attempts a rebound, this level could serve as a major hurdle.

A deeper pullback may see Bitcoin testing the 61.8% retracement level at $75,259, aligning with recent price action.

Meanwhile, the Relative Strength Index (RSI) currently sits at 34.19, approaching oversold territory but lacking a strong bullish divergence.

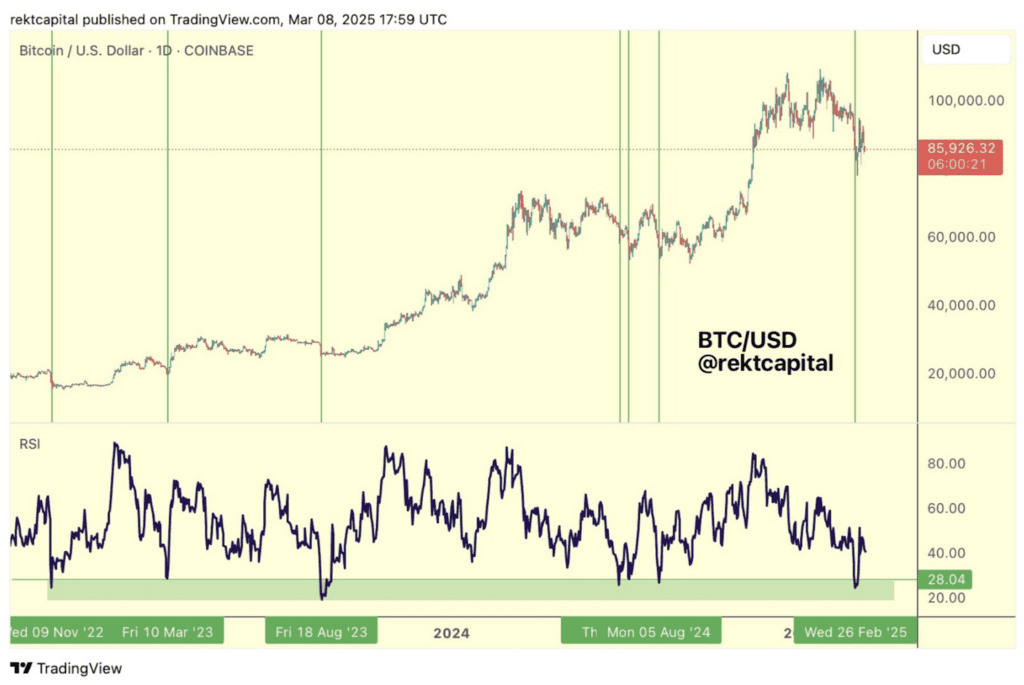

Crypto analyst Rekt Capital noted that past Bitcoin price bottoms have historically formed when daily RSI dipped below 28.

“Bitcoin’s price would either bottom or be between -2% to -8% away from a bottom,” Rekt Capital explained, suggesting that a local low may be near but not yet confirmed.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)