Bitcoin Breaks Out Above $94K as Institutions Double Down Despite Short-Term Risk

Bitcoin confirms breakout above $94K, driven by strong spot demand and institutional accumulation. Analysts eye $98.8K as the next key target despite upcoming FOMC risk.

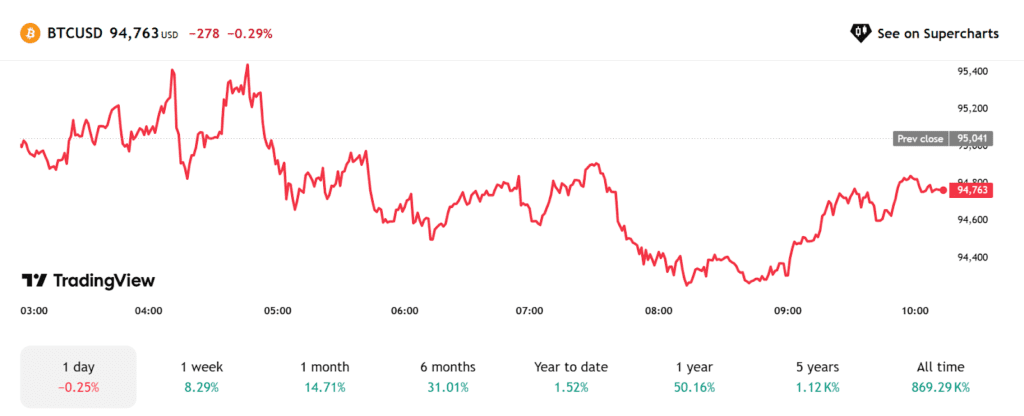

Bitcoin is surging with renewed strength, pushing past key resistance levels and igniting bullish momentum across the market. As of now, BTC trades confidently above $94,000, supported by robust spot demand and high-volume inflows from institutional giants

Online advertising service 1lx.online

🔼 Spot Strength Confirms Breakout

Since early April, Bitcoin has consistently printed higher lows and higher highs. This bullish structure, coupled with steadily increasing trading volume, reflects strong interest from both retail and institutional buyers. A well-defined ascending trendline offers technical support near $94,200, while Bitcoin continues to trade above its 100-hourly simple moving average—a classic signal of trend strength.

Analysts now eye a potential continuation, with $95,500 being the next significant hurdle. A clear break above it could send BTC rallying toward $96,250, $97,500, and even $98,800. Indicators like the hourly MACD are showing upward momentum, and the RSI remains above 50, further reinforcing the bullish sentiment.

🏦 Institutional Accumulation Fuels Momentum

Institutions are not waiting on the sidelines. Strategy, the Bitcoin-centric investment firm led by Michael Saylor, recently added 15,355 BTC in April alone—worth $1.42 billion at an average of $92,737 per coin. As of April 28, Strategy holds a staggering 553,555 BTC, purchased at an average cost of $68,459, with a YTD yield of 13.7%.

With a target to reach a 15% yield by 2025, Strategy’s aggressive buying puts further pressure on the circulating supply and underpins Bitcoin’s current rally. Notably, its stock price has climbed to $368.7, largely in sync with Bitcoin’s upward trend.

⚠️ Short-Term Risks from FOMC, But Quarterly Trend Dominates

Online advertising service 1lx.online

Some caution remains ahead of the upcoming Federal Open Market Committee (FOMC) meeting on May 7. Historical trends show that Bitcoin has often experienced short-term pullbacks around FOMC announcements due to shifts in investor sentiment. Analyst @astronomer_zero noted that these reactions are usually temporary and less significant compared to longer time frame trends.

“The quarterly move is spot-driven, powerful, and outweighs short-term FOMC risks,” he emphasized. On-chain data supports this, as negative funding rates, shallow local retracements, and persistent spot premiums all suggest the current rally has legs.

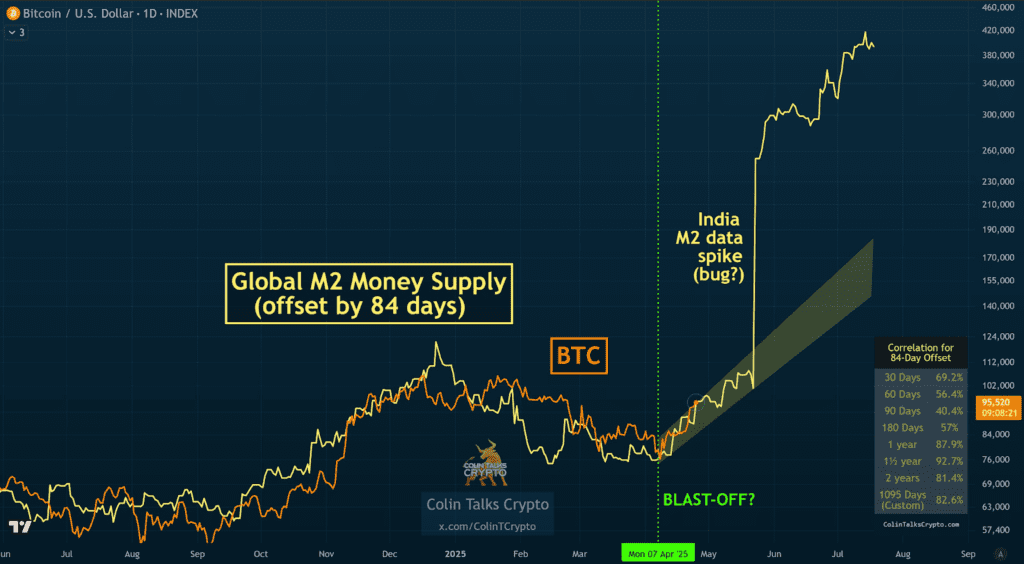

🌍 Macro Forces Continue to Align

Beyond technicals and on-chain metrics, macroeconomic trends are painting a bullish backdrop. Global M2 money supply is rising, institutional participation continues to grow, and Bitcoin’s scarcity is playing an increasing role in price action.

Online advertising service 1lx.online

According to Colin Talks Crypto, the rally is validated by Tether dominance and macro liquidity flows. Standard Chartered’s Geoff Kendrick also remains bullish, projecting BTC to hit $120,000 in Q2 and potentially $200,000 by year’s end.

Meanwhile, long-term holders remain steadfast, refusing to sell into strength and further tightening supply. With ETF inflows surging and corporate treasuries like Strategy absorbing large chunks of available supply, the path of least resistance remains upward.

🔚 What’s Next?

The $95,500 resistance level is now under close watch. A confirmed breakout above it could pave the way for Bitcoin to test $98,800 and potentially challenge its all-time high. Short-term support zones remain firm at $94,200 and $93,500—likely to absorb any FOMC-induced volatility.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)