Uniswap Fully Unlocked: Key Stakeholders Hold Over 700 Million UNI as Market Awaits Volatility

Uniswap has reached 100% supply unlock, with over 700 million UNI tokens still held by key stakeholders like a16z. Despite the full unlock, only 25.83% of UNI is circulating. Net outflows signal possible accumulation, but market volatility looms as large holders await better conditions to release more tokens.

Uniswap [UNI], one of the most prominent decentralized finance (DeFi) platforms, has reached a significant milestone, with 100% of its token supply now fully unlocked. Despite this achievement, only 25.83% of the total 1 billion UNI tokens—around 258.3 million—are currently circulating in the market, according to analysis by @EmberCN.

Distribution and Current Circulation

Online advertising service 1lx.online

Uniswap’s token distribution structure has played a key role in controlling the amount of UNI circulating. Early on, 17% of the total UNI supply was distributed through liquidity provider (LP) staking rewards and airdrops to early adopters, making up a part of the circulating supply today. However, the remaining 83% of the UNI supply has been allocated to the community treasury, team members, investors, and advisors, who have taken a cautious approach with their holdings.

While the entire 430 million UNI allocated to the community treasury has been unlocked, only around 30 million UNI tokens have entered the market. Similarly, of the 400 million tokens allocated to team members, investors, and advisors, only 58.16 million UNI has been sold so far. This cautious approach has helped prevent any sudden influx of tokens that could potentially disrupt the market price.

Holders Show Long-Term Confidence

Despite the full unlocking of all UNI tokens, there has been no significant sell-off from key stakeholders. Notably, over 700 million UNI tokens remain held by the team, advisors, and investors, including Andreessen Horowitz (a16z), signaling long-term confidence in the project’s future.

This holding behavior has contributed to market stability, as large holders appear to be waiting for more favorable conditions before releasing more of their tokens into circulation. The cautious release strategy may reflect a broader confidence in Uniswap’s future growth, suggesting that key stakeholders are playing the long game.

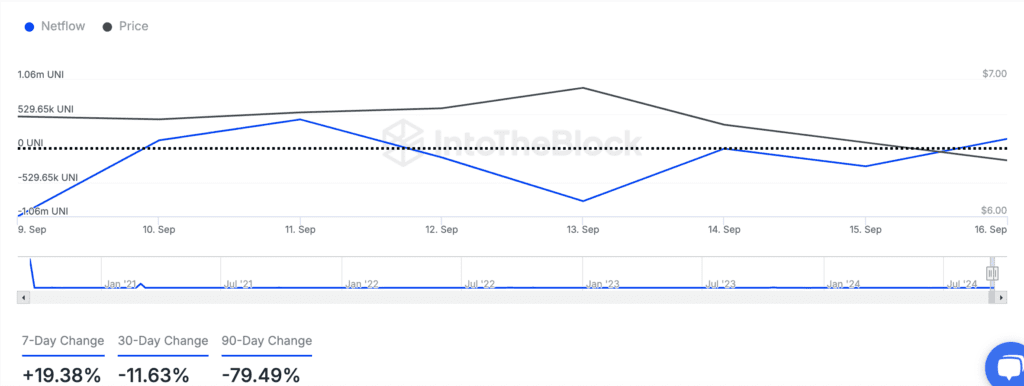

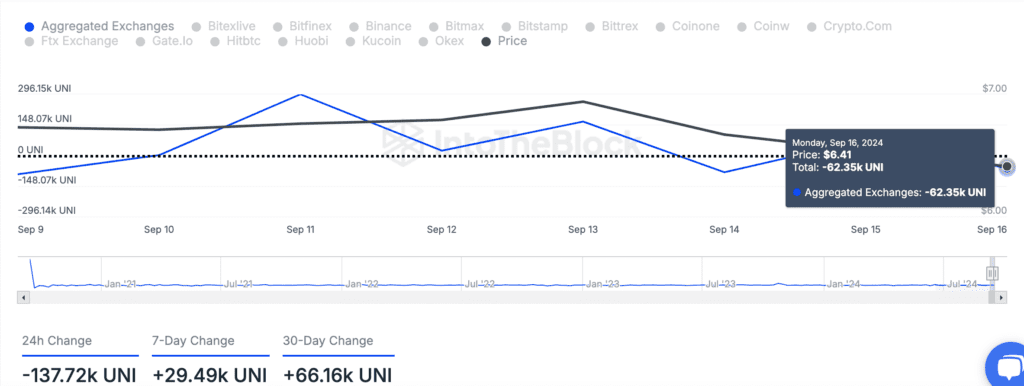

UNI Outflows Signal Accumulation Surge

Recent data from IntoTheBlock indicates a mix of inflows and outflows for UNI. On September 16th, net outflows of 62,350 UNI were recorded, signaling that more tokens were being withdrawn from exchanges—potentially indicating long-term holding or staking intentions. Over the last seven days, net inflows have increased by 19.38%, suggesting some accumulation by large holders.

Online advertising service 1lx.online

However, over the past 30 and 90 days, the trend has been one of net outflows, pointing to a possible reduction in large-holder activity over time. Despite these fluctuations, UNI’s price has remained relatively stable, with a 2.55% increase in the past 24 hours and a 1.09% rise over the past week.

Potential Market Volatility Ahead

At press time, UNI is valued at $6.63, with a 24-hour trading volume of $138 million and a circulating supply of 750 million UNI. This gives Uniswap a market capitalization of nearly $5 billion. However, market volatility could arise if large stakeholders decide to sell more of their holdings, especially with over 700 million UNI tokens still in reserve.

As the market digests the recent full unlock, investors will be closely monitoring large-holder behavior and any potential signs of increased sell pressure, which could significantly impact future price action.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)

Online advertising service 1lx.online