NFT Market Faces Liquidation Wave as Azuki and Pudgy Penguins Experience Sharp Price Declines

The NFT lending market is under pressure as Azuki and Pudgy Penguins face major price drops. Over 150 Pudgy Penguins loans and hundreds of Azuki-backed loans on BendDAO are underwater, raising liquidation concerns.

The NFT market is once again experiencing a wave of turbulence as two of its most prominent collections, Azuki and Pudgy Penguins, face steep price declines. This volatility has triggered a surge in underwater loans on NFT lending protocols, putting both investors and lending platforms in a precarious situation.

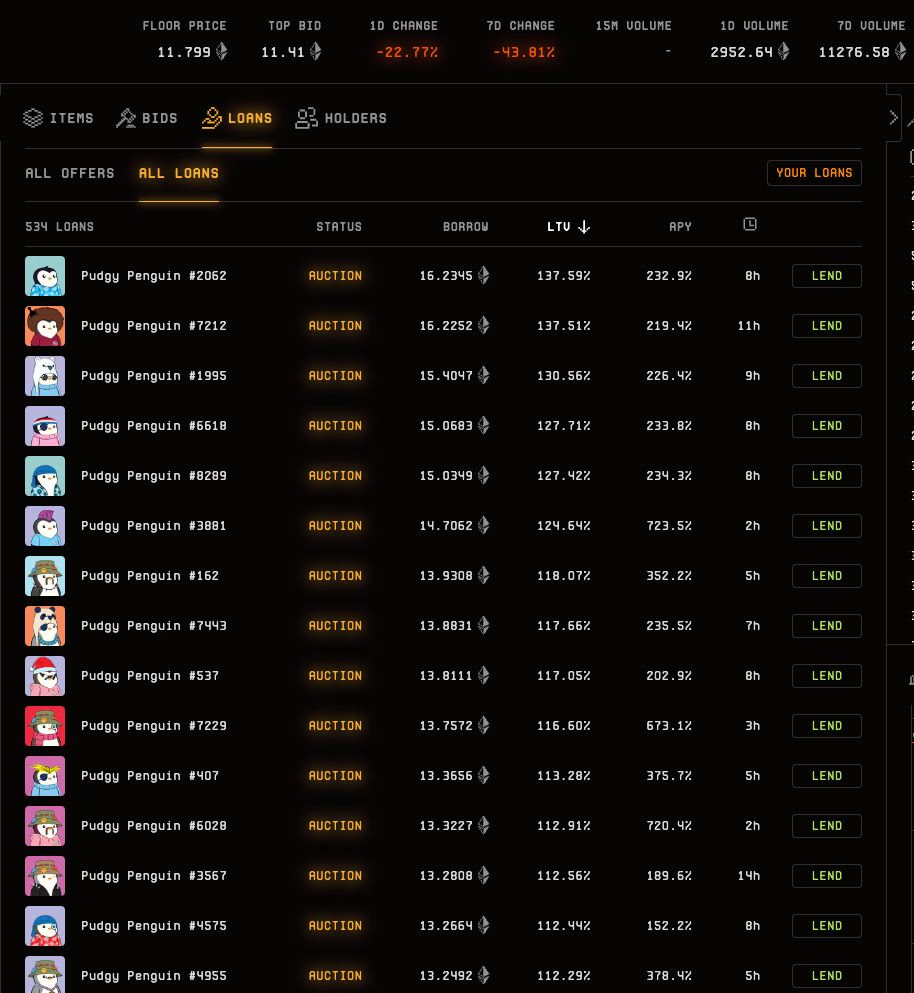

As of this morning, over 150 Pudgy Penguins-related loans on Blend, Blur’s NFT lending protocol, are at risk, along with hundreds of Azuki-backed loans on BendDAO. Borrowers took advantage of slow oracle updates, allowing them to secure loans at outdated NFT valuations.

Online advertising service 1lx.online

Massive Liquidation Threats for NFT Holders

The Pudgy Penguins ecosystem has seen the most impacted loans concentrated in Lil Pudgies, a secondary collection. Reports indicate that 81 Lil Pudgies have loan-to-value (LTV) ratios exceeding 100%, meaning their debts surpass their NFT’s floor price.

The situation worsened when Pudgy Penguins’ floor price plummeted from 17 ETH to 11 ETH in just 24 hours. The crash was triggered by uncertainty surrounding its role in the Abstract token airdrop. Since borrowers owe more than their NFTs are worth, many are unlikely to repay their loans, compounding the risk for lenders.

Azuki’s price drop was even more dramatic, plunging from 11 ETH to 3.75 ETH following the ANIME token airdrop on January 24. According to NFT analyst Stats, Azuki holders exploited BendDAO’s slow price updates, borrowing over 5 ETH per NFT even though floor prices had already dropped below 4.8 ETH.

BendDAO Faces Mounting Pressure

BendDAO, already facing criticism for past liquidity crises, has seen interest rates skyrocket due to the liquidity crunch:

- ETH interest rates surged to 164%

- USDT interest rates climbed to 92%

To counteract the crisis, BendDAO has proposed a treasury-backed intervention, using its reserves to bid on distressed Azuki assets. Additionally, the protocol is considering a flagging system to prevent new borrowing after extreme price swings.

Online advertising service 1lx.online

DeFi and NFT Lending at a Crossroads

While the liquidation threat has intensified selling pressure, some analysts believe blue-chip NFTs like Azuki and Pudgy Penguins will still attract buyers at lower prices. NFT analyst Wale noted:

“This isn’t the first Blend crisis, and blue-chip NFTs typically find incremental buyers. There’s no reason to panic, but it’s a key metric to watch when trading NFTs.”

However, critics argue that BendDAO’s slow oracle system is a structural weakness that could ultimately undermine the protocol. PunksOTC, a leading CryptoPunks trading desk, issued a scathing critique:

“At some point, the lagging oracle will kill the protocol. Hopefully, this $ANIME airdrop is the beginning of the end, and people migrate to more modern lending platforms.”

Online advertising service 1lx.online

As the NFT market matures, efficient risk management in lending protocols will become increasingly important. The industry is watching closely to see whether BendDAO and Blend can adapt, or if new competitors will rise to replace them.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)