Bitcoin Mining Faces Perfect Storm: Tariffs, Halving, and Historic Hashpower Pressure

Bitcoin miners are under siege as tariffs raise hardware costs, hashpower hits new highs, and BTC drops 30%, squeezing profitability across the sector.

Bitcoin Miners Are in Trouble: Tariffs, Trade War, and Hashpower

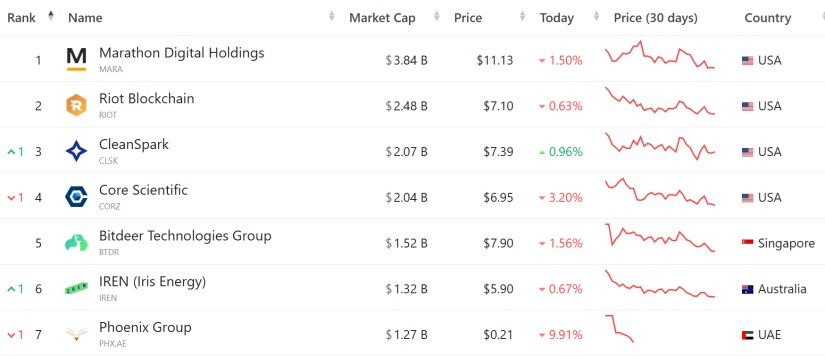

The Bitcoin mining industry is confronting one of its most turbulent phases in years. On Monday, leading mining companies like Marathon Digital (MARA), Riot Platforms (RIOT), and CleanSpark (CLSK) witnessed sharp share declines—each plunging over 10% in early trading hours. This adds to an already worrying downtrend from the prior week, with crypto-adjacent firms like Coinbase and MicroStrategy also seeing red across their boards.

Online advertising service 1lx.online

📉 A Market That Offers No Mercy

Geopolitical friction has now entered the mining equation. Escalating trade tensions between the U.S. and China have resulted in a fresh round of tariffs from Washington, directly targeting imports of mining hardware. Since a large portion of ASIC machines originates from China, these tariffs have triggered a spike in equipment costs for U.S.-based operations—many of which are already reeling from Bitcoin’s halving-induced revenue drop.

Adding to the pressure, Bitcoin’s total network hashpower has surged past 1 zettahash per second, marking an all-time high. This unprecedented level of competition increases the difficulty of mining blocks, meaning miners must expend more energy and resources just to maintain their positions. The result? A devastating plunge in hashprice—the industry benchmark measuring profitability per unit of hashpower—which has now hit a record low of $42.40 per PH/s/day.

💸 Falling BTC Prices Compound the Crisis

Just when miners needed relief, the market delivered the opposite. Bitcoin’s price, which was comfortably trading above $109,000, has tumbled to around $78,000, carving away nearly 30% of miners’ revenue streams. This drastic fall has left even the most efficient mining firms scrambling to cut costs or increase efficiency in a race for survival.

In the face of surging energy costs, diminishing rewards, and geopolitical headwinds, the Bitcoin mining sector is now being forced to adapt or perish. Whether through relocation, vertical integration, or innovation, companies must rapidly evolve or risk becoming casualties of a shifting landscape that’s increasingly inhospitable to the unprepared.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)