TRON Activity Hits All-Time High as On-Chain Metrics Outpace Price Action

TRON is breaking usage records with unmatched USDT transfer volumes and fee revenue, but its price remains stagnant—raising questions about a potential breakout.

TRON (TRX) has surged back into the spotlight—not due to market hype, but because of explosive real-world usage that now places it among the top-performing blockchains in 2025.

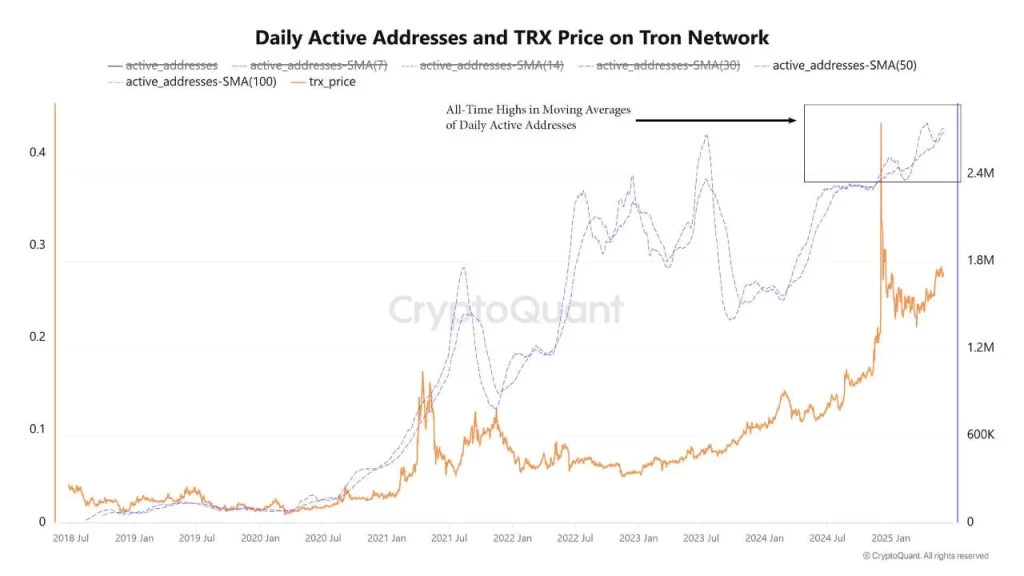

During the first week of June, TRON’s daily active address count hit record highs, pushing both the 50-day and 100-day moving averages to all-time peaks. Perhaps more impressively, the network’s volume of USDT transactions has overtaken even Ethereum’s, cementing TRON’s position as the top global platform for stablecoin transfers.

Online advertising service 1lx.online

In May alone, TRON recorded $121.2 billion in transaction volume, moving over 490 billion TRX. Currently, $71 billion worth of USDT is circulating on the TRON network—just short of Ethereum’s $74.5 billion. Furthermore, TRON generated $13.3 million in weekly fees, outperforming both Ethereum and Solana. Its monthly protocol revenue climbed to a new high of $343 million, all driven by authentic network usage rather than speculative spikes.

However, this impressive fundamental strength hasn’t been reflected in TRX’s price. Despite massive utility and adoption, TRX has hovered around $0.27, with technical indicators like the MACD and Chaikin Money Flow signaling mild bearish trends or consolidation. Analysts believe that such divergences—where usage outpaces price—often precede significant surges, particularly in proof-of-stake ecosystems like TRON.

If TRX breaks past the psychological $0.30 barrier, Fibonacci extensions indicate the next price targets could range between $0.3265 and $0.43.

Several forces are fueling TRON’s performance:

- Stablecoin dominance: Particularly in emerging markets, TRON has become the preferred network for fast and inexpensive USDT transfers.

- Whale accumulation: On-chain data confirms that major holders are steadily acquiring more TRX, indicating growing confidence.

- Staking innovation: The rollout of improved staking mechanisms and validator incentives later this summer is expected to boost TRX demand.

Meanwhile, tools like SunPump, used for monitoring token generation, are hinting at accumulation phases—an early indicator of possible bullish moves.

Although Total Value Locked (TVL) on TRON has dipped since December 2024, its transactional throughput remains robust. Solana is drawing some users with lower fees, but TRON’s unmatched stablecoin infrastructure and its 2.66 million long-term holders point to a stable, growing ecosystem.

Online advertising service 1lx.online

Crypto analysts are divided. While some believe TRON is on the verge of a price rally, others caution that unless TVL and DeFi adoption rebound, the price may lag behind fundamentals.

With USDT volumes at unprecedented levels and real usage skyrocketing, traders now wait to see if TRON’s fundamentals will finally ignite the rally many have anticipated.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)