Solana Eyes Breakout Above $180 as On-Chain Metrics and Institutional Buys Fuel Momentum

Solana nears $180 resistance after 52% monthly growth, with bullish patterns, rising DeFi activity, and institutional accumulation driving a potential breakout rally.

Solana (SOL) is testing a critical resistance level at $180 after surging more than 52% in the past month. With technical indicators flashing bullish signals and institutional wallets steadily accumulating, many analysts are watching for a breakout that could trigger a massive rally.

Online advertising service 1lx.online

At the time of writing, Solana trades around $175.74, with a 24-hour volume of $3.51 billion and a market cap of $91.34 billion. Despite the minor daily gain of 0.65%, the bigger picture reveals growing momentum.

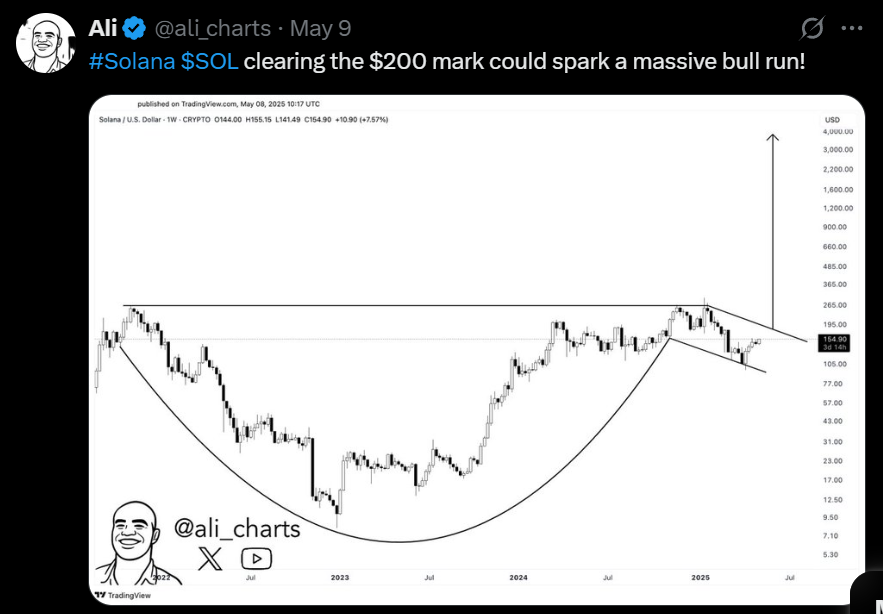

According to analysts like Crypto Virtuos and Ali Martinez, Solana’s price pattern is forming a classic cup-and-handle—a technical formation often associated with explosive upside potential. Martinez highlights that breaking above the $200 mark may pave the way to $510, and possibly even $2,000, if bullish conditions persist.

🔎 Institutional Inflows & Accumulation

Increased institutional interest is reinforcing the current rally. Data from CoinMarketCap shows that major funds like SOL Strategies and DeFi Dev Corp recently acquired over 200,000 SOL, pushing total holdings beyond 395,000 tokens. This signals a long-term commitment and belief in Solana’s ecosystem.

Adding to the narrative, Robinhood is reportedly exploring the use of Solana blockchain to tokenize U.S. stocks for European clients—a move that could significantly broaden the chain’s institutional reach and usage in regulated financial products.

⚙️ On-Chain Momentum & DeFi Usage

Network data also paints a bullish picture. Solana’s monthly transaction volume surpassed 1.5 billion, underscoring the blockchain’s high throughput and robust demand. At the same time, DEX trading volumes on Solana exceeded $500 million in 2025, a signal of growing user activity and liquidity.

This spike in utility suggests more than speculative hype—real adoption is strengthening the fundamental foundation behind the price action.

Online advertising service 1lx.online

📊 Futures, Funding, and Technical Patterns

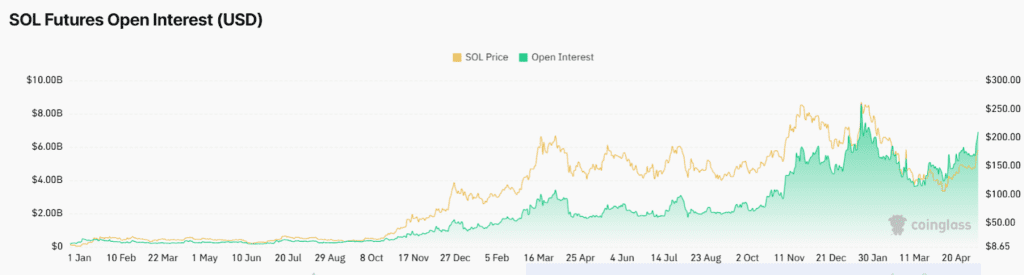

According to CoinGlass, there’s a strong correlation between Solana’s spot price and its futures Open Interest (OI), which climbed to nearly $10 billion during price peaks. This rise indicates increased participation and speculation in the futures market.

Additionally, the SOL OI-weighted funding rate has turned positive for the first time since April, signaling renewed bullish sentiment. The trend reflects more long positions opening, aligned with rising price action.

On the charts, Solana appears to be forming an inverse head-and-shoulders pattern, with a neckline at $160. A sustained break above $180 would confirm this bullish formation, with technical forecasters pointing to $200 and beyond as the next major levels.

Online advertising service 1lx.online

Recent liquidations and whale movements further support the case. Over $30 million in short positions have been liquidated in tandem with a $18.2 million SOL purchase, showing rising investor confidence and positioning for upside.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)