Ethereum Active Addresses Surge 17%—Is a Price Rebound Coming?

Ethereum active addresses have surged 17% in 24 hours, yet ETH price continues to decline. With Q2 historically strong, traders are watching for a breakout. Will ETH follow Bitcoin 2020 rally?

Ethereum Sees a Surge in Network Activity—Will Price Follow?

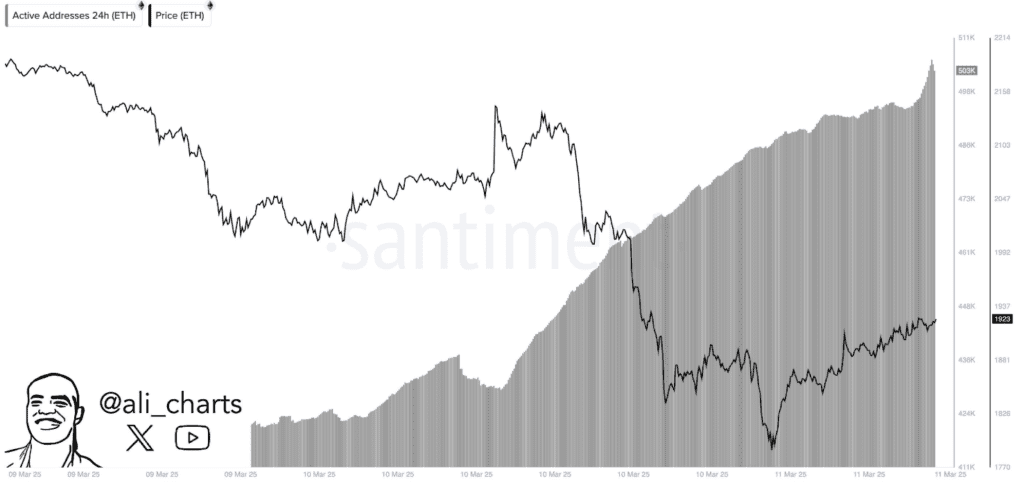

Ethereum’s network activity is soaring, with active addresses increasing by 22.3% in three days, according to Santiment data. In just 24 hours, Ethereum saw a 17% jump in active addresses, signaling growing network engagement.

Online advertising service 1lx.online

Typically, higher network activity correlates with bullish price action. Increased usage often indicates higher demand, which can push prices up. However, this time, ETH’s price has not reacted as expected.

Despite the surge in addresses, Ethereum has declined from $2,158 on March 10 to $1,923 on March 11. Historically, this kind of divergence suggests short-term selling pressure from whales or cautious traders. However, the sustained rise in network activity may indicate that buying pressure is building beneath the surface.

Ethereum Q1 Weakness Could Set Up a Strong Q2 Rebound

Ethereum has faced one of its worst Q1 performances, declining 42.9% since the start of 2025. However, historical trends suggest that weak Q1s often precede strong Q2 recoveries:

- 2023: ETH gained 52.15% in Q1, dipped (-5.74%) in Q2, then surged +36.66% in Q4.

- 2022: After a brutal (-10.75%) Q1 and (-67.34%) Q2, ETH rebounded +24.09% in Q3.

Historically, Q2 has been one of Ethereum’s strongest quarters, with an average return of +66.84%. If this trend continues, ETH could be poised for a strong recovery in the coming months.

Institutional Adoption and Supply Squeeze Could Fuel Growth

Ethereum’s institutional adoption is accelerating, with major banks becoming ETH validators. Additionally, the expected launch of Ethereum ETFs that enable staking could reduce circulating supply, strengthening long-term price stability.

Online advertising service 1lx.online

With fewer ETH tokens available on the market, a supply squeeze could help drive prices higher, reinforcing bullish momentum in Q2 and beyond.

Is Ethereum Repeating Bitcoin’s 2020 Bull Cycle?

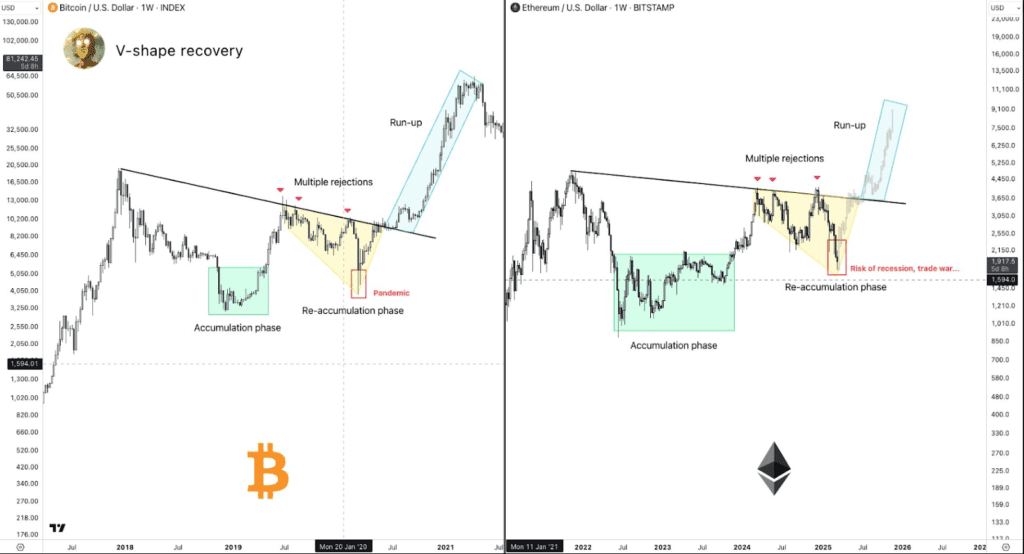

Ethereum’s current price structure mirrors Bitcoin’s 2018–2020 cycle, where BTC spent months consolidating before breaking out.

Right now, ETH is in a re-accumulation phase, similar to Bitcoin before its 2020 bull run. The price action has faced multiple resistance rejections, frustrating traders, but this pattern is a normal part of price discovery.

Online advertising service 1lx.online

Interestingly, Ethereum’s current decline also resembles Bitcoin’s 2020 crash, when macro uncertainty spooked investors before BTC ultimately surged to new all-time highs.

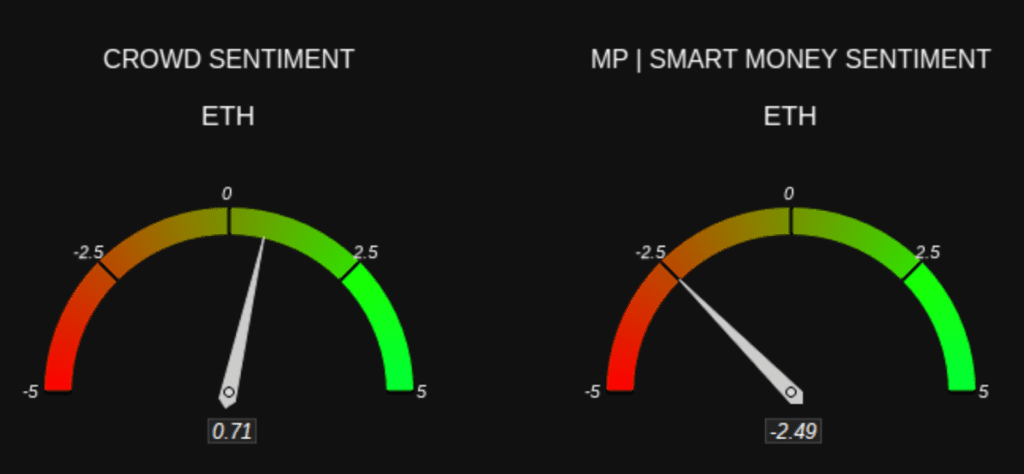

At present, retail traders remain bullish (0.71 sentiment index), while institutional investors lean bearish (-2.49 sentiment index). This discrepancy suggests potential price swings before a confirmed uptrend.

What’s Next for Ethereum?

Ethereum’s network activity is climbing, institutional interest is increasing, and historical patterns suggest Q2 could be a turning point.

Will ETH replicate Bitcoin’s 2020 bull breakout, or will traders see more sideways action before a decisive move?

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)