Ether Supply on Exchanges Hits Near-Decade Low—Is a Mega Pump Imminent?

Ethereum supply on crypto exchanges has dropped to its lowest level since 2015, sparking hopes of a supply shock that could trigger a massive price surge, despite recent bearish sentiment.

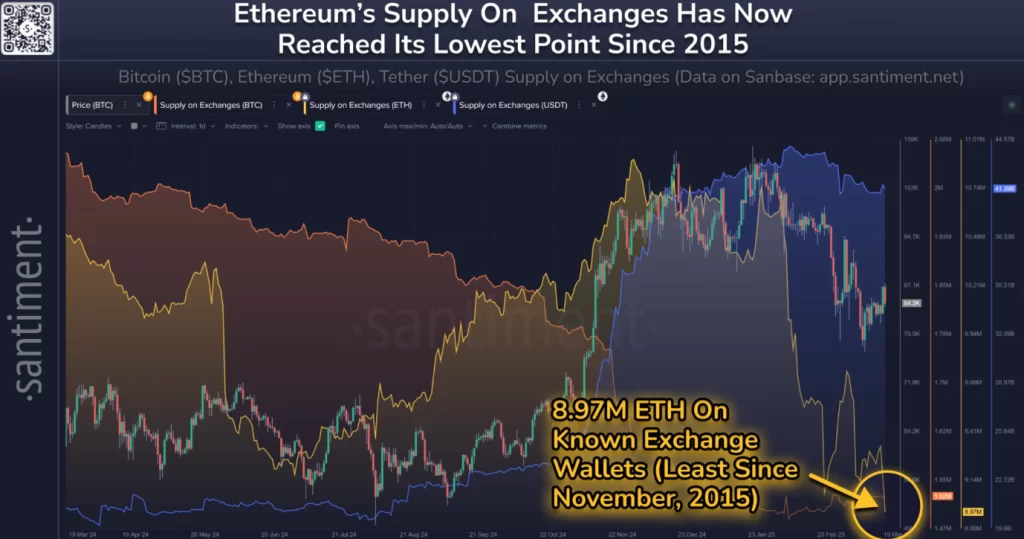

Ethereum Exchange Balances Plummet to 2015 Levels, Hinting at Supply Shock

Ethereum (ETH) is showing signs of a potential bullish reversal, even as its price has dropped 26% in the past month. According to blockchain analytics platform Santiment, the amount of ETH available on centralized exchanges has fallen to 8.97 million, its lowest level in nearly a decade, dating back to November 2015.

Online advertising service 1lx.online

This dramatic decline in exchange-held ETH suggests that holders are increasingly moving their tokens to cold storage, reducing the immediately tradable supply. This behavior is typically interpreted as a signal of investor confidence, as long-term holders prepare for a price surge rather than short-term selling.

Analysts Eye “Supply Shock” as Catalyst for ETH Mega Pump

Crypto market analysts have started to speculate that Ethereum could be on the verge of a major rally—driven by what is known as a “supply shock.” This term refers to a scenario where supply becomes extremely limited, but demand either holds steady or increases, leading to a rapid rise in price.

Santiment noted that ETH balances on exchanges are now 16.4% lower than they were just two months ago, at the end of January. A similar trend was recently observed with Bitcoin: on January 13, Bitcoin reserves on exchanges hit a seven-year low, and within days BTC surged to a new high of $109,000, coinciding with political momentum following President Trump’s inauguration.

Trader Sentiment Turns Bullish Despite Downtrend

Several crypto influencers and traders are now pointing to the shrinking ETH supply as a leading indicator of price action:

- Crypto General posted, “Just a question of time before the big supply shock.”

- Ted, another analyst, said buyers will soon “compete, leading to bidding wars.”

- Naber, a crypto trader, predicted a price target between $8,000 and $10,000, which would represent a 64% increase from ETH’s all-time high of $4,878.

These predictions are driven not just by supply data but also by the belief that ETH accumulation is underway at scale.

Online advertising service 1lx.online

Contradictory Indicators: Spot ETF Outflows and Weak BTC Pairing

However, not all signals point toward a breakout. While on-chain metrics suggest accumulation, Ethereum’s performance against Bitcoin remains at a five-year low, casting doubt on near-term dominance shifts in the crypto market.

Crypto analyst Daan Crypto Trades highlighted ETH’s persistent weakness, suggesting it’s “unlikely to see this anywhere near its highs anytime soon.” Additionally, spot Ether ETFs have seen 12 consecutive days of outflows, totaling $370.6 million, according to data from Farside.

These trends underscore the split sentiment in the market: one side anticipates a powerful bounce driven by fundamentals, while the other sees warning signs of deeper macro weakness.

Online advertising service 1lx.online

Ethereum at a Crossroads: Bounce or Breakdown?

Prominent trader Scott Melker, also known as “The Wolf of All Streets,” summarized the moment with a stark statement:

“Either Ethereum bounces here and this is a generational bottom, or it’s over.”

At the time of writing, ETH trades at $1,971, and all eyes are on whether it can recover key technical levels in the coming weeks. If the supply reduction narrative holds true and demand accelerates, Ethereum could follow in Bitcoin’s recent footsteps—and possibly surpass expectations with a breakout of its own.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)