Ether Sees $296M Surge as Fed Caution Slows Bitcoin Flows

Ether funds recorded their best inflows since Trump’s 2024 win, while Bitcoin faced outflows amid Fed uncertainty.

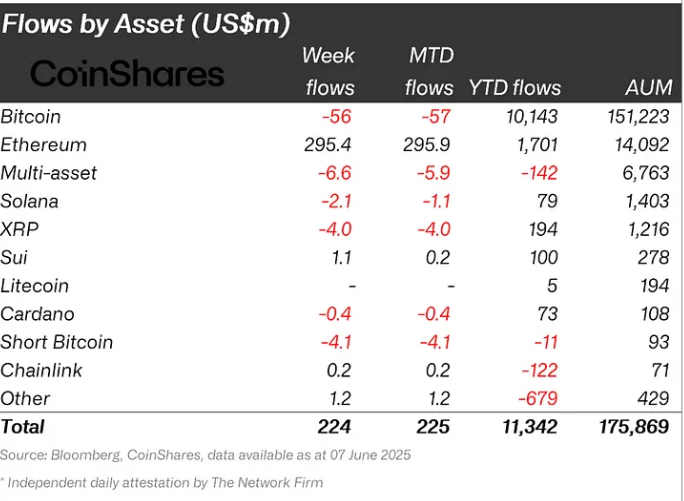

Ether-focused crypto investment products saw a major upswing last week, drawing in $296 million in inflows — the strongest weekly performance since Donald Trump’s 2024 presidential victory, according to data from CoinShares released on Monday.

Online advertising service 1lx.online

Despite a generally subdued market environment with investors hesitant ahead of the next Federal Reserve decision, Ether-based exchange-traded products (ETPs) dominated crypto fund flows. These products now represent over 10.5% of the total assets under management (AUM) across all crypto ETPs.

This also marks the seventh consecutive week of inflows into Ether funds, signaling what CoinShares describes as a “notable recovery in investor sentiment.” The data suggests a growing optimism surrounding Ethereum’s mid-term prospects, especially in light of ongoing network improvements and anticipated ETF support.

Commenting on price outlooks, Ryan Lee, chief analyst at Bitget Research, noted that Ether may trade between $2,400 and $2,800, constrained by trade concerns and deflationary pressures. However, he suggested that if ETF momentum continues and no broader selloff materializes, $2,700 could be retested, while $2,300 may serve as a critical support in downturn scenarios.

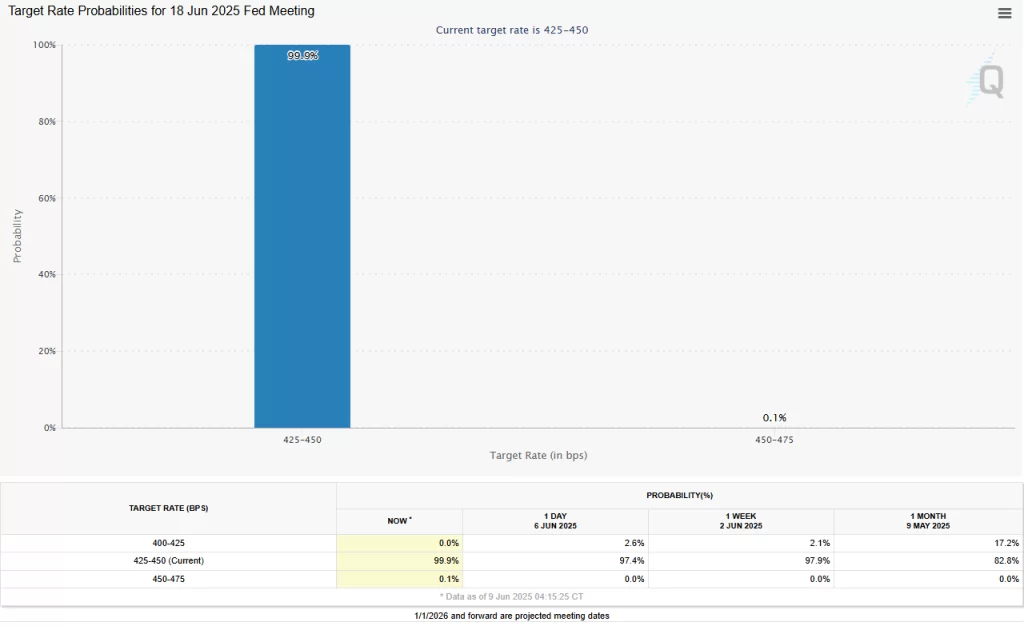

On a broader scale, digital asset products brought in a total of $286 million in net inflows over the past week. However, Bitcoin-based funds saw net outflows of $56 million, making it the second week of losses in a row. The report attributed this pullback to investor caution ahead of the upcoming Federal Open Market Committee (FOMC) meeting on June 18.

According to CME Group’s FedWatch Tool, markets are currently assigning a 99.9% probability that the Fed will keep interest rates unchanged. This standoffish approach is contributing to investor hesitation, particularly in Bitcoin, which is viewed as highly sensitive to rate decisions.

Meanwhile, analysts like Alice Li from Foresight Ventures are keeping a long-term bullish outlook. Speaking during Cointelegraph’s Chain Reaction X Spaces, she said:

“I believe in Bitcoin’s long-term trajectory. I think we could see it reach $150,000 in this cycle, especially if macro conditions turn.”

On the venture capital side, the pace of investment in the crypto space has notably slowed, with only 62 funding rounds closed in May — the lowest count of 2025 so far — totaling $909 million in raised capital.

Online advertising service 1lx.online

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)