Crypto Treasury Mania Backfires: Bitcoin Hoarders See Shares Plunge

The “crypto treasury” boom is facing its first real stress test as shares in Bitcoin-hoarding companies tumble, with some firms now trading below the value of their token holdings.

Shares of companies that piled into Bitcoin and other cryptocurrencies have slumped sharply, signaling the first major setback for the so-called “crypto treasury” strategy that dominated financial headlines this summer.

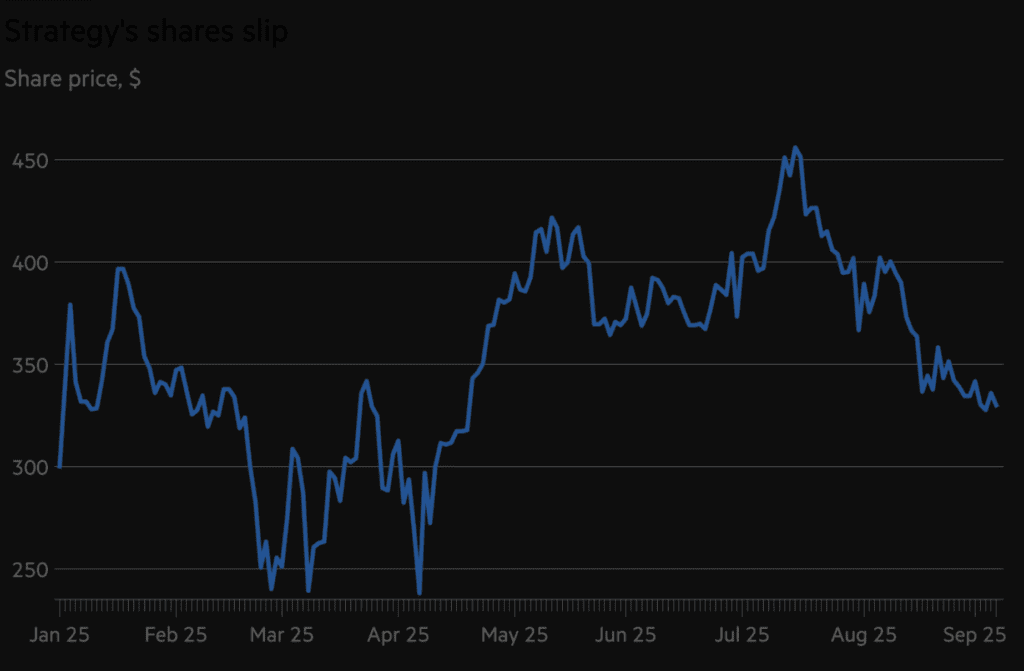

Strategy Inc., the world’s largest corporate holder of Bitcoin, has seen its stock drop 18% over the past month, its lowest since April. This decline has dragged down dozens of firms that sought to emulate founder Michael Saylor’s playbook of raising debt or equity to amass crypto reserves.

Online advertising service 1lx.online

Across global markets, companies rushed to issue shares and bonds this summer to acquire Bitcoin, Ethereum, Solana, and XRP—betting that token holdings would supercharge valuations. Many saw their market caps soar above the value of their digital assets, reinforcing investor belief in this model. But the recent sell-off has exposed cracks: several firms are now worth less than their underlying crypto reserves.

Eric Benoist, tech and data research specialist at Natixis CIB, warned: “This whole thing is starting to show big cracks. Some companies are not going to make it through if share prices keep falling.” He predicted that weaker entrants could be “wiped out” as market discipline takes hold.

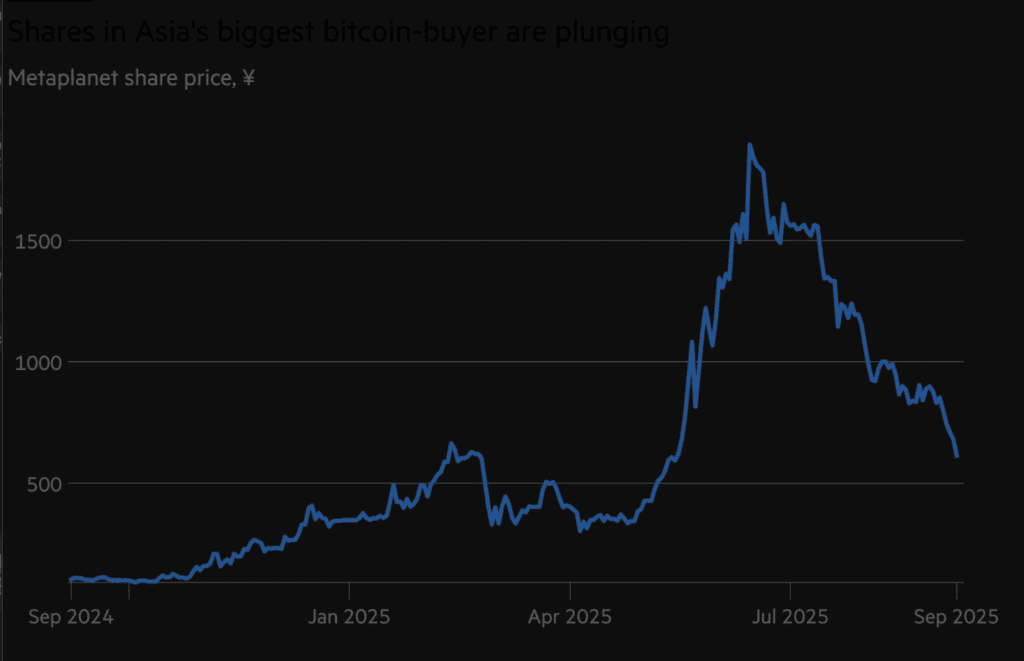

Among the hardest hit is Metaplanet, the Japanese hotelier turned Asia’s largest Bitcoin holder, whose shares have plunged 68% from June’s peak. Smarter Web Company, the UK’s largest corporate Bitcoin buyer, has collapsed 70% in the same period. Standard Chartered’s digital assets head Geoff Kendrick noted that the frenzy “got a bit crazy,” with too many entrants chasing the same idea.

The strategy hinges on raising funds through debt or new share issuance to buy more crypto—fueling a feedback loop of higher token and share prices. While Strategy’s stock soared from $60 to over $500 last year, it now trades closer to $326. As valuations fall, raising capital becomes harder, especially when bondholders expect payouts. Benoist stressed: “Selling new shares just to pay bondholders is not sustainable.”

Several companies even sidelined their original businesses to pivot into crypto. KindlyMD, a healthcare service, and Capital B, a French tech group, both shifted to Bitcoin buying but have seen share prices sink 68% and 26%, respectively. Others, like Trump-linked Alt5 Sigma, launched with the sole purpose of building crypto treasuries. Its shares have dropped 35% since July.

Investors are now focused on Michael Saylor’s mNAV metric—a ratio of enterprise value to crypto holdings. If a firm’s market value falls below its token stash, it enters a “danger zone” with little hope of recovery. U.S. miner LM Funding America has reached this stage, with a market value of $23.5 million despite Bitcoin reserves worth $34 million. Healthcare company Semler Scientific faces a similar scenario.

Despite the downturn, fundraising hasn’t stopped. Forward Industries raised $1.65 billion to create a Solana treasury strategy, while Eightco Holdings bet on Worldcoin tokens. Still, analysts like Tyler Evans of UTXO Management believe the hype peaked in summer: “The hype is dying down. That was the peak for both excitement and the number of new launches.”

Online advertising service 1lx.online

With Bitcoin down 9% from its $124,000 July high and risk appetite fading, the once-unstoppable crypto treasury trend is facing its toughest test yet.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)