Could Gold Fund America Bitcoin Vault? Fed Study Reveals Strategic Path

The U.S. Federal Reserve is evaluating whether profits from gold revaluation could be used to build a strategic Bitcoin reserve. A new report details how other nations leveraged gold gains for national liquidity—and how the U.S. might follow.

A fresh report by the U.S. Federal Reserve has reignited speculation over a potential pivot in America’s monetary strategy—using profits from revalued gold reserves to finance a national Bitcoin reserve.

The Fed’s study, titled “Official Reserve Revaluations: The International Experience,” reviews how five nations—Germany, Italy, Lebanon, Curaçao and Saint Martin, and South Africa—have historically tapped into gold valuation gains to support liquidity. The report, while not explicitly advocating the move for the U.S., outlines detailed mechanisms these countries employed, offering a potential blueprint for similar action.

Online advertising service 1lx.online

Notably, in some cases, countries reduced public debt through gold-derived funds. Others used the revenue to offset central bank losses or stabilize economic metrics.

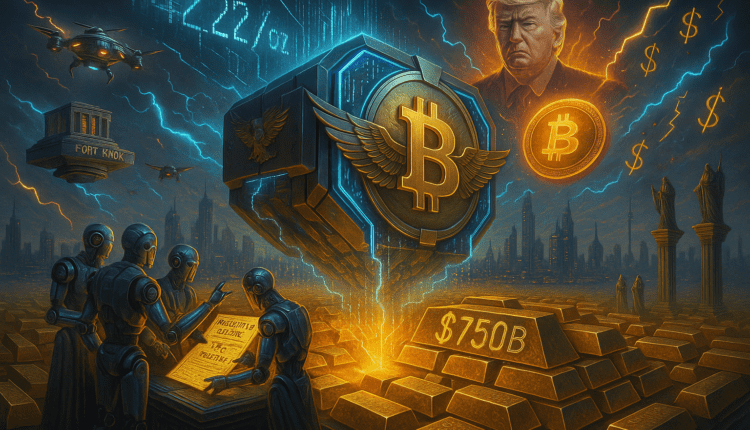

Currently, the U.S. Treasury assigns a statutory price of $42.22 per ounce to its gold holdings—unchanged since 1973. With 261.5 million ounces in reserve, primarily stored in Fort Knox, these assets are officially valued at approximately $11 billion. However, at contemporary market rates, their value would exceed $750 billion.

This enormous valuation gap is the core of the proposal’s intrigue: unlocking that “hidden” value could offer the financial muscle to fuel new economic strategies—like the acquisition of digital assets.

Adding fuel to the speculation, the Trump administration has already initiated groundwork for a strategic Bitcoin reserve. On March 6, the President signed an executive order authorizing the creation of such a reserve—albeit initially funded only by cryptocurrencies seized in past legal actions.

While the Fed’s report stops short of recommending any direct course of action, the timing is telling. As economic paradigms shift globally, and digital assets become integral to sovereign balance sheets, the U.S. may be quietly charting its entry into Bitcoin-backed monetary reserves—funded not by new debt, but by gold that’s been lying dormant for decades.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)