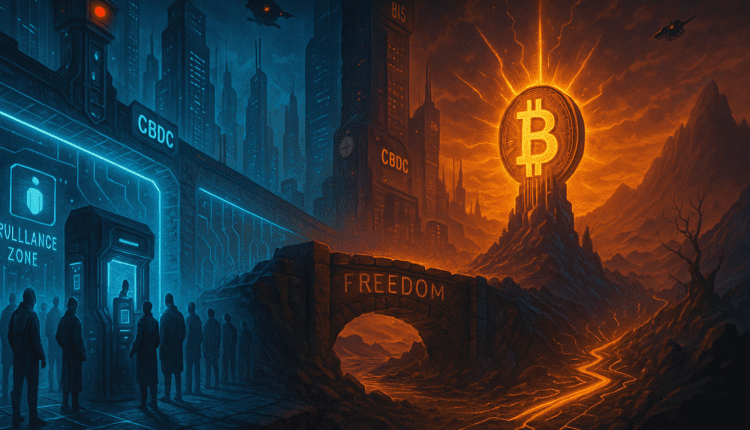

Bitcoin vs. Digital Fiat: Freedom at Stake in the Age of Monetary Surveillance

As central banks race to deploy digital currencies, Bitcoin emerges as the last line of defense for financial freedom and sovereignty.

In an increasingly digitized world, a silent war is being waged between financial freedom and institutional control. At the center of this conflict stands Bitcoin — a decentralized, censorship-resistant form of money — opposing the rise of central bank digital currencies (CBDCs) and regulated stablecoins.

Across the globe, governments are rapidly developing and deploying retail-level CBDCs. Though marketed as modern upgrades to outdated cash systems, these digital currencies risk becoming instruments of surveillance and financial control.

Online advertising service 1lx.online

The warning isn’t hypothetical. Augustin Carstens, head of the Bank for International Settlements — the central bank of central banks — openly stated that CBDCs would grant central authorities “absolute control on the rules and regulations” governing money usage, enabled by the very technology that makes them possible.

This “absolute control” could manifest in chilling ways. CBDCs may be programmed to limit what you can buy, when, and from whom. Transactions might be restricted based on compliance with state policies on climate, health, or taxes. Balances could even expire or force spending into state-approved assets. While officials may promise restraint, as the UK Parliament’s Economic Affairs Committee noted, such promises are only valid “until successors disagree.”

This is why Bitcoin’s role is so crucial. Unlike fiat — digital or physical — Bitcoin is built on decentralization and mathematical integrity. Bitcoin held in self-custody cannot be censored, frozen, or manipulated by central banks or political institutions. It has served as a lifeline in regions plagued by authoritarian capital controls — from Ukraine to Afghanistan, Cuba to Russia. From WikiLeaks in 2011 to humanitarian causes in 2025, Bitcoin has remained the unstoppable alternative.

Moreover, CBDCs introduce systemic vulnerabilities. The UK’s Economic Affairs Committee warns that centralized ledgers are prime targets for cyberattacks, both by rogue nations and organized hackers. Given governments’ poor track records on cybersecurity, entrusting them with total control over personal funds is a risky proposition.

By contrast, Bitcoin has been battle-tested for over a decade. With zero downtime and no successful hacks on its ledger, it remains the most resilient financial network ever built. Not even global banks or tech giants can boast this reliability.

And the threat isn’t limited to government-issued currencies. In the U.S., despite a presidential order barring CBDC development, regulated stablecoins are filling the vacuum. These “private” assets like USDT already adhere to intense federal oversight. Tether’s CEO Paolo Ardoino has confirmed collaboration with agencies like the FBI and DOJ, stating that the company enforces freezes per U.S. demands — even though it doesn’t operate from within the country.

This blurs the line: CBDCs may come not as direct state-issued money, but as hybrid systems enforced through corporatized digital fiat — stablecoins with backdoors. It’s the same control, hidden behind a different logo.

Yet amid this tightening web, there’s still a way out. Bitcoin remains the only open-access, non-custodial, permissionless alternative. As monetary systems shift from physical cash to programmable control, Bitcoin is not just an investment. It’s digital dissent — a defense mechanism against financial serfdom.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)

Online advertising service 1lx.online