Bitcoin Targets Brutal Short Squeeze as Price Tests $108K and Fed Shift Looms

Bitcoin nears the quarterly close with rising volatility and a potential short squeeze. Traders eye $108K liquidity zone amid bullish bets and looming Fed leadership change.

Bitcoin slipped to near $107,000 after the Wall Street open on June 30, as markets braced for a volatile end to the month and quarter. Analysts now warn of a potential “brutal” short squeeze, with leverage and liquidity stacking around critical resistance zones.

Online advertising service 1lx.online

According to data from Cointelegraph Markets Pro and TradingView, BTC/USD reversed recent weekend gains, trading down 1.1% on the day as of writing. With only hours left before monthly and quarterly candles close, traders expected volatility to intensify.

In its latest update to Telegram subscribers, QCP Capital observed a notable shift in funding conditions across major exchanges. As Bitcoin approached $108K, perpetual funding rates flipped positive, indicating that leveraged long positions were building quickly.

“Positioning appears to be chasing the move,” QCP wrote, “as participants lean into directional bets ahead of quarter-end.”

Liquidity Clusters and Short Liquidation Threat

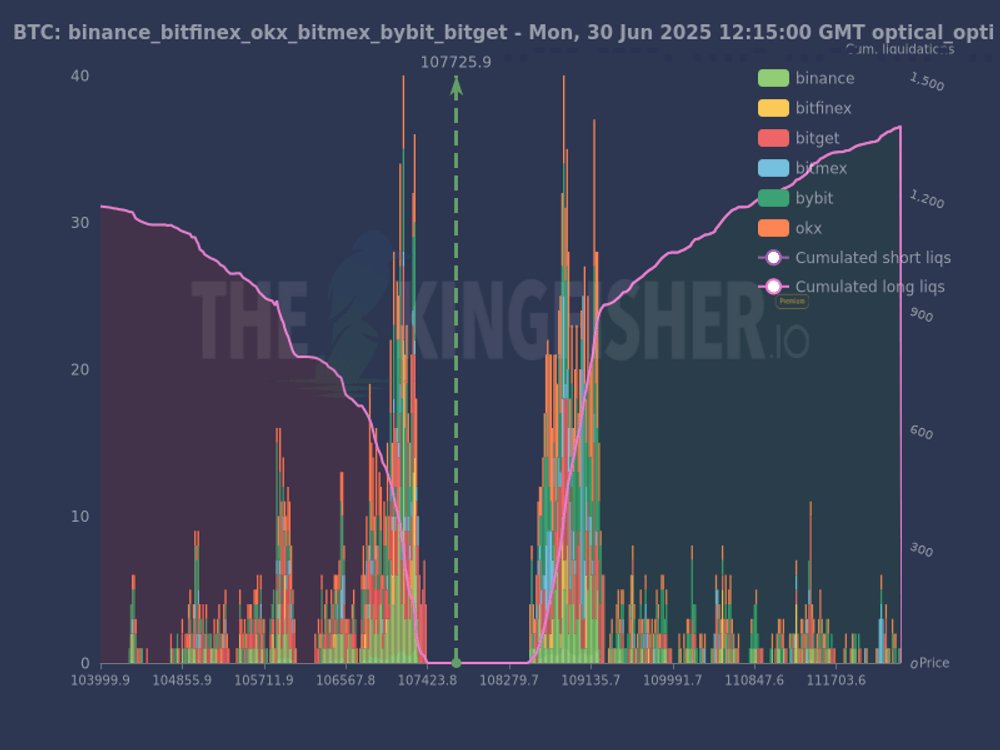

Prominent trading account TheKingfisher noted that long liquidations cluster between $106K–$107K, while a significant wall of short liquidations sits immediately above current prices — especially intense between $108K and $108.5K.

“That’s a strong magnet,” TheKingfisher warned.

“Short squeezes can be brutal if price pushes through $107.5K.”

Meanwhile, trader and analyst Rekt Capital took a more cautious tone. According to his analysis, Bitcoin recently rebounded from a local green support zone but is now pulling back for a retest.

“Continued stability here would enable another challenge of the Main Downtrend dating back to late May,” he explained, referencing a long-term resistance line.

Online advertising service 1lx.online

Macro Tailwinds: Fed Shake-Up and Risk-On Momentum

Outside crypto, macro developments also added fuel to the fire. Reports emerged that Washington is planning to replace Jerome Powell as Chair of the Federal Reserve. The move, if it includes interest rate cuts, could serve as a powerful tailwind for risk assets like Bitcoin.

“If the new Fed Chair actually cuts rates to 1%, we are going to witness perhaps one of the biggest runs of all time in stocks and real estate,” predicted The Kobeissi Letter, a popular trading insights publication.

Current interest rates sit at 4.25%, and President Donald Trump has publicly criticized Powell, pushing for significantly lower rates.

Online advertising service 1lx.online

Further adding to bullish momentum was Ric Edelman, founder of Edelman Financial Services, who recommended investors allocate up to 40% of their portfolios to crypto — a bold stance from a firm managing over $300 billion in assets.

With exchange liquidity heating up, short positions vulnerable to rapid liquidation, and macro forces aligning in crypto’s favor, the stage is set for potentially explosive upside — should Bitcoin breach that $108K resistance wall.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)