Bitcoin Hits New 2025 Highs: Will Strong Buying Pressure Push BTC to $90K?

Bitcoin price surged past $87,000 amid rising whale accumulation and declining exchange supply, suggesting bullish sentiment may drive BTC toward $90K.

Bitcoin [BTC] is making headlines once again after registering a significant upward move in the past week. From a local bottom near $76,600, the cryptocurrency climbed to a yearly high of $87,470, signaling a possible shift in market sentiment and momentum.

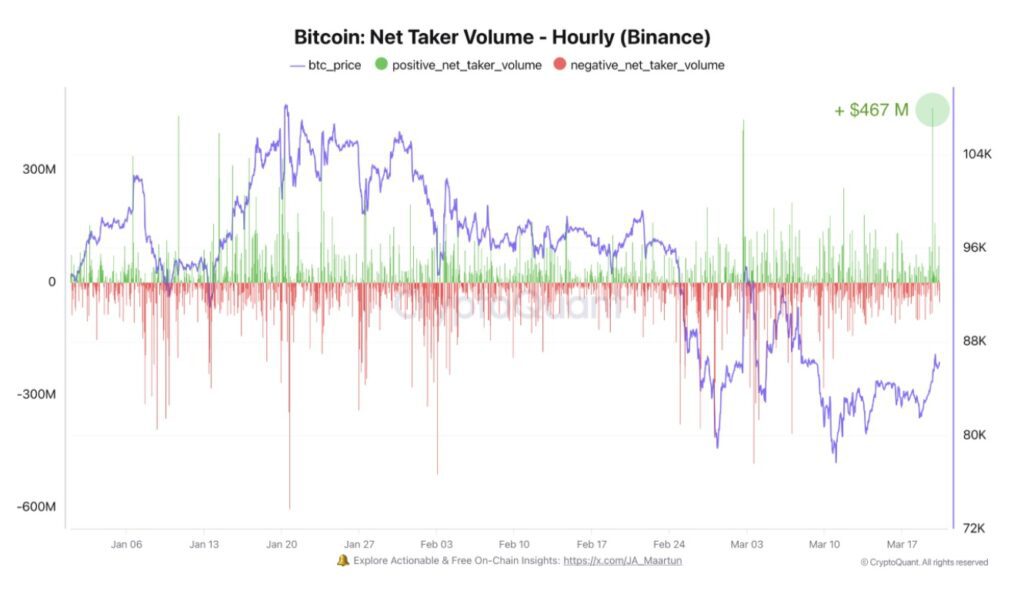

According to fresh data from CryptoQuant, this latest surge has been accompanied by a notable rise in net taker volume on Binance—clocking in at $467 million, the highest level recorded in 2025. As Binance commands the majority of trading volume in the space, this spike in activity suggests that investors are regaining confidence and that bullish momentum may be returning.

Online advertising service 1lx.online

Another indicator of this shift is the sharp reduction in short-term coin supply. Specifically, the proportion of Bitcoin aged one week or less dropped from 5.9% to 2.8%, a sign that fewer coins are being made available for trading. This reduction typically reflects growing HODLing behavior and tightening market supply.

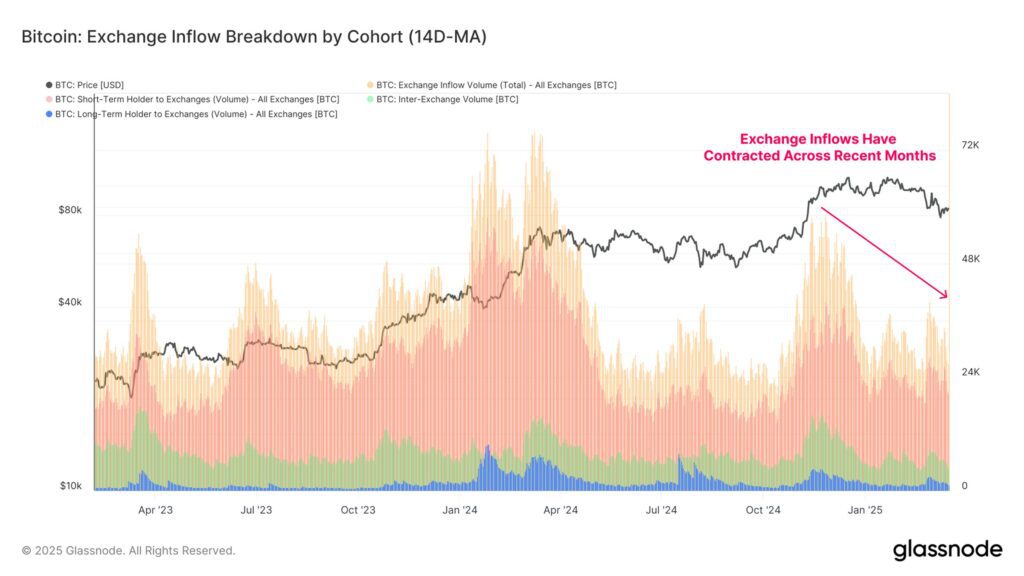

Adding to this trend, exchange inflows have plummeted—from 58.6k BTC per day down to just 26.9k BTC. The 54% drop is yet another confirmation that sell-side pressure is decreasing, often a precursor to price stability or even further upward movement.

Whales Accumulate While Retail Joins the Ride

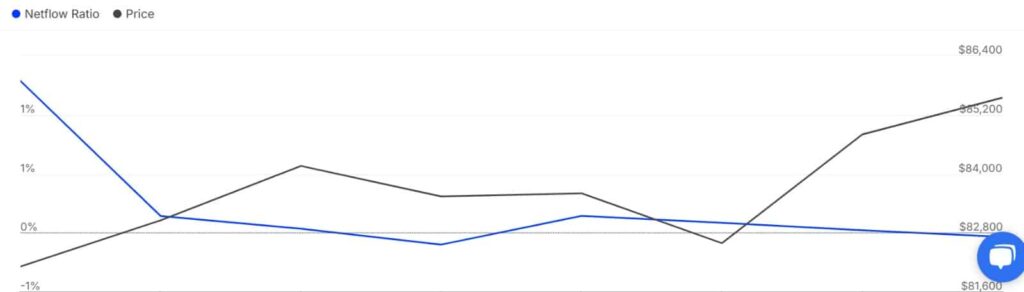

Behavioral analytics show that large holders—commonly referred to as whales—are now buying more than they are selling. The Large Holders Netflow to Exchange Netflow Ratio has dipped into the negative, going from 0.17% to -0.04%. This means whales are withdrawing their assets from exchanges rather than preparing to sell them—an unmistakable signal of long-term bullish sentiment.

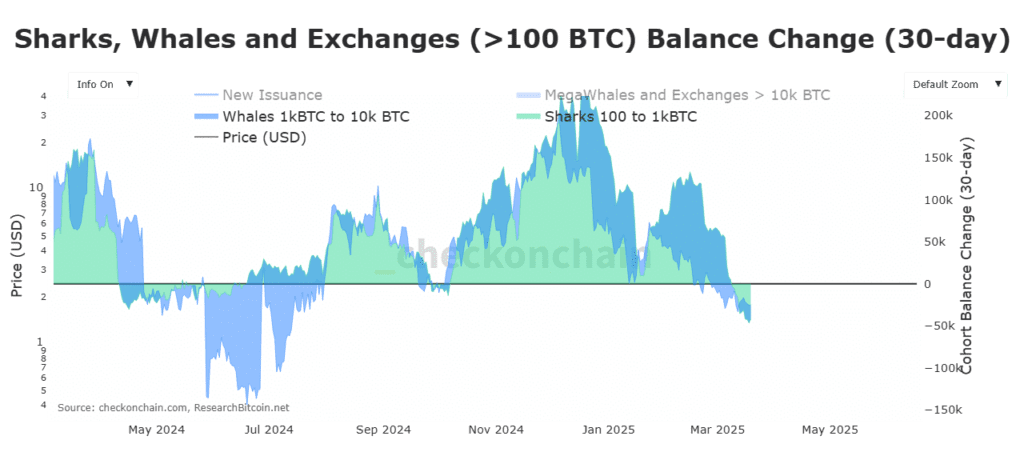

Supporting this, both shark and whale wallet categories have shown a consistent decrease in exchange balances over the past month. Data from CheckOnChain reveals a coordinated withdrawal trend by these entities, underlining a broad accumulation phase as major investors move coins into cold storage.

What’s Next for BTC?

With the uptick in demand, a bullish structure appears to be taking shape. If buying pressure persists, Bitcoin could soon challenge and potentially break the $86,000 resistance level. A confirmed move beyond this threshold would pave the way for BTC to aim for $90,000 in the short to medium term.

Online advertising service 1lx.online

However, if early buyers who entered sub-$80k levels begin to take profits, a brief pullback to $82,000 could be on the cards. Nonetheless, as long as institutional and whale demand continues, any dip may be short-lived.

This stage of the cycle seems to reflect growing belief in Bitcoin’s resilience, supported by data-driven investor behavior and tightening market supply.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)