Bitcoin Faces “Red September” Risk as Analysts Warn of Deeper Slide

Bitcoin enters September under pressure, down 6.5% in August and trading around $108,000. Analysts highlight portfolio rebalancing and shrinking liquidity as warning signs for another difficult mont.

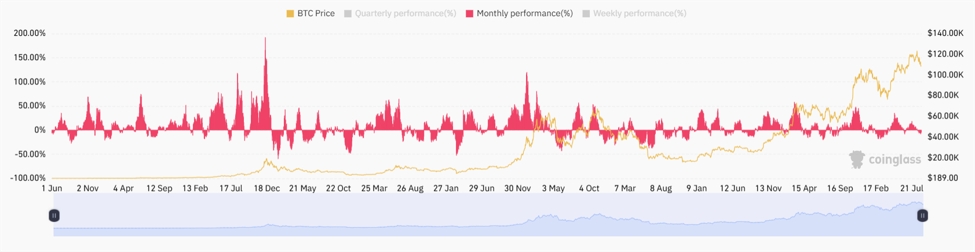

Historically, September has been one of Bitcoin weakest months, and 2025 appears to be no exception as investors brace for potential further downside. After losing about 6.5% in August, Bitcoin is currently trading near $108,000, raising concerns that the market may be entering another “Red September.”

Online advertising service 1lx.online

Market experts suggest that seasonal portfolio adjustments are playing a central role. As traditional investors rebalance their holdings at the end of the summer, liquidity in the crypto sector tends to thin out. This reduced buying power makes it harder for Bitcoin to resist downward pressure, especially after months of heightened volatility.

Liquidity strains are also evident on exchanges, where reserves continue to trend lower as institutions move assets into cold storage and treasuries. While long-term investors see this as a bullish sign of accumulation, it leaves spot markets more vulnerable to sharp swings when sell orders appear.

Analysts note that macro conditions are further complicating the picture. Uncertainty around U.S. monetary policy, fluctuating Treasury yields, and inflation data all feed into market sentiment. While the Federal Reserve’s dovish signals earlier in August sparked optimism, a recent downturn has reignited doubts about whether Bitcoin can sustain momentum above the six-figure mark.

Some traders argue that Bitcoin could test deeper support levels, potentially in the $100,000–$105,000 range, if September follows its historical trend of weakness. Others remain cautiously optimistic, pointing out that Bitcoin’s fundamentals—including ETF inflows, corporate treasury adoption, and growing institutional participation—remain strong in the long run.

For now, the market remains divided: will this September mark yet another seasonal dip, or could Bitcoin surprise by breaking its historical curse? Either way, the next few weeks may prove decisive for the crypto giant’s path into Q4 2025.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)

Online advertising service 1lx.online