Bitcoin ETFs Record $3B Surge as April Ends on High Note, Institutions Turn Ultra Bullish

U.S. spot Bitcoin ETFs log $3 billion in inflows over five days, reversing April’s trend. BlackRock and ARK signal growing institutional confidence as BTC holds near $95,000.

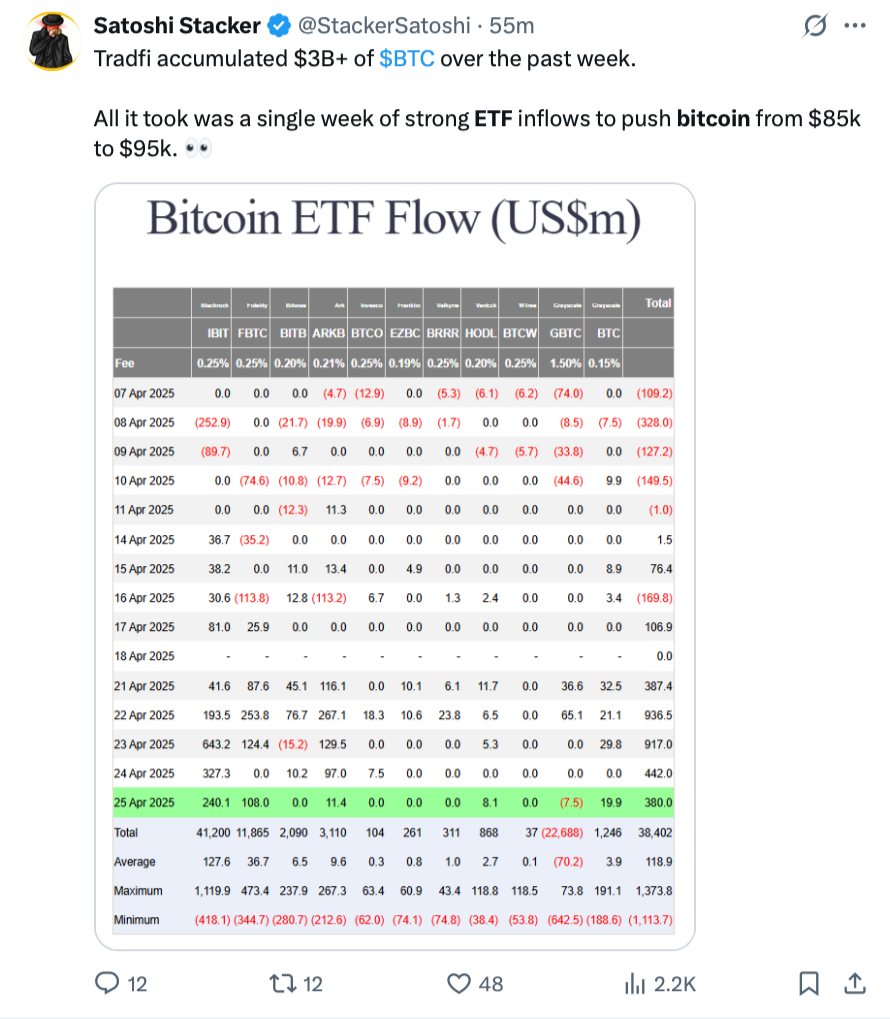

April 25, 2025 – After a volatile start to the month, spot Bitcoin ETFs in the United States are staging a dramatic comeback. With over $3.06 billion in inflows across five consecutive trading days, April is closing on a resoundingly bullish note for Bitcoin investment products.

According to Farside data, April 25 alone brought in $380 million, marking the first full week of inflows in five weeks for the 11 approved U.S. spot Bitcoin ETFs. The last similar run occurred in the week ending March 21.

Online advertising service 1lx.online

“ETFs are on a Bitcoin bender,” wrote Bloomberg ETF analyst Eric Balchunas on X.

“What’s really notable here is just HOW FAST the flows can go from 1st gear to 5th gear.”

Balchunas speculated that a revived basis trade strategy—where institutions arbitrage between spot and futures markets—may be contributing to the inflow acceleration.

💹 April Turns Green as Net Inflows Hit $2.26B

Despite enduring nine outflow days across 18 trading sessions earlier in the month, Bitcoin ETFs have officially pushed April’s net inflow total to $2.26 billion. The reversal underscores a shift in sentiment amid macroeconomic uncertainty, as institutions rotate back into digital assets.

The market momentum was further fueled by bullish sentiment from Michael Saylor, who at the Bitwise Invest Bitcoin Corporations Investor Day, predicted that BlackRock’s iShares Bitcoin ETF (IBIT) would become the “largest ETF in the world within ten years.”

Two days prior, IBIT won “Best New ETF” at the annual etf.com awards, also claiming the title of “Crypto ETP of the Year.”

📈 Bitcoin Holds Strong, Institutions Raise the Stakes

Meanwhile, Bitcoin’s spot price remains steady at $94,613, according to CoinMarketCap, reflecting increasing market stability despite global financial headwinds.

Online advertising service 1lx.online

Institutional conviction continues to mount. Billion-dollar asset manager ARK Invest recently raised its bull case target for Bitcoin from $1.5 million to $2.4 million by 2030. This projection is driven by increasing institutional demand and Bitcoin’s strengthening position as “digital gold.”

ARK also revised its other projections upward:

- Base Case: $1.2 million

- Bear Case: $500,000

These aggressive targets signal that leading financial institutions are beginning to view Bitcoin not as a volatile experiment—but as a long-term macro asset.

As ETFs see renewed inflows and major financial players amplify their price targets, Bitcoin appears to be entering a new phase of institutional legitimacy and accelerated adoption.

Online advertising service 1lx.online

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)