Bitcoin Energy Value Hints at $167K Fair Price — 45% Above Today Levels

Bitcoin “Energy Value” metric suggests its fair price could be as high as $167,800, far above its current $116,000. Record hashrates signal that the network fundamentals remain strong.

Bitcoin true market worth could reach $167,800 per coin if its trading price aligned with its “Energy Value,” according to Charles Edwards, founder of crypto asset manager Capriole Investments.

In a post on X this Thursday, Edwards calculated that Bitcoin is currently undervalued by roughly 45% compared to its energy-based valuation, which considers miner activity as the key driver of intrinsic value.

Online advertising service 1lx.online

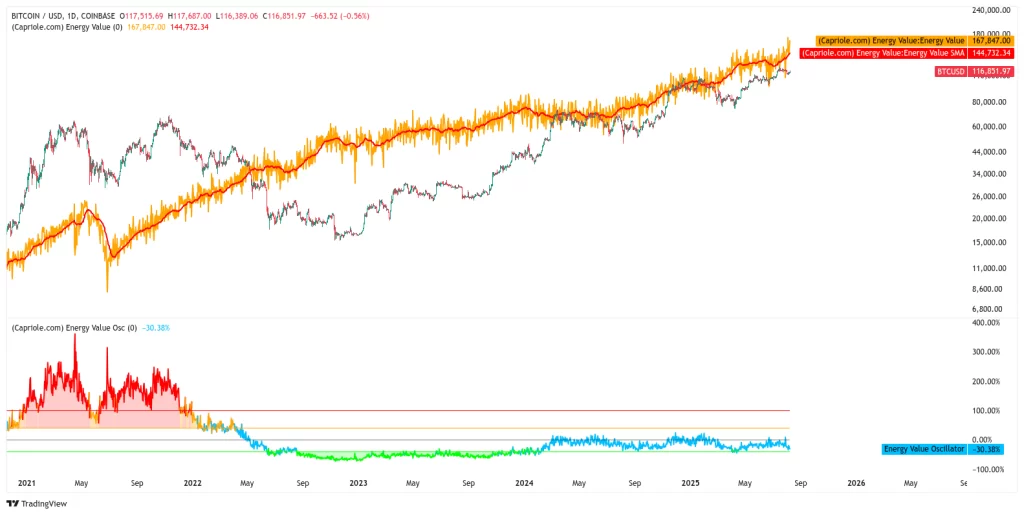

The “Energy Value” metric, introduced by Capriole in 2019, defines Bitcoin’s fair price as a function of three main variables: total network energy input, supply growth rate, and a constant representing the fiat value of energy. This means that if mining activity were to cease completely, BTC’s value would theoretically drop to zero. However, with hashrates hitting record highs, Bitcoin’s fundamentals remain robust.

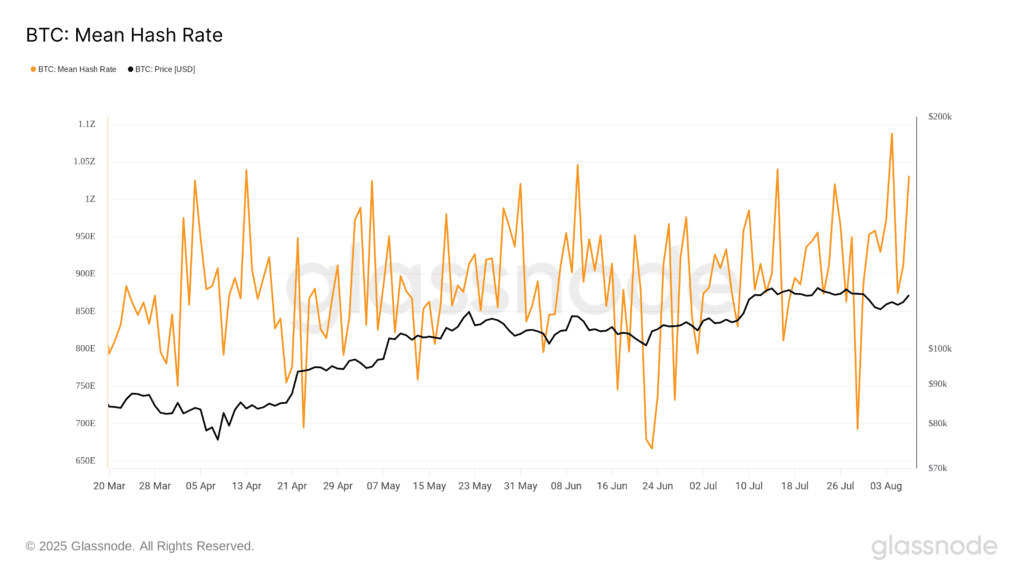

Data from on-chain analytics firm Glassnode shows the network’s current hashrate at 1.031 zettahashes per second (ZH/s), reaching a new all-time high on August 4. Edwards noted that the metric’s simple moving average (SMA) for Energy Value has reached $145,000, placing BTC at a 31% discount to this level. The Energy Value’s peak has touched $167,800, contrasting sharply with Bitcoin’s current price, which has dipped nearly 10% from its record highs last month.

“We’re trading at a deeper discount to value today at $116K than we were when Bitcoin was $10K in September 2020,” Edwards emphasized.

The Capriole team explains that steady energy input reflects a healthy supply-demand balance. Rising market prices tend to boost energy investment as miners increase hashrate through technological upgrades and improved efficiency, pushing Bitcoin’s Energy Value higher. However, when speculative rallies cause prices to surge far beyond the energy-supported value, historical trends show that the market often corrects back down to Energy Value.

Meanwhile, the Hash Ribbons metric—another mining-related indicator—remains in bullish territory, with its latest “buy signal” appearing in late July. This reinforces a positive outlook for miners and suggests that price performance may still have room to grow, even as the current bull cycle moves into its final months.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)

Online advertising service 1lx.online