Bitcoin Emerges as Digital Gold While Wall Street Stumbles

Bitcoin diverges from tech stocks and aligns with gold as investors seek safe-haven assets amid political tension and dollar decline.

In a market environment once dominated by the synchronized dance of tech stocks and cryptocurrencies, a distinct shift has emerged: Bitcoin is breaking away. The world’s leading cryptocurrency has surged in recent weeks while major U.S. stock indices—such as the S&P 500 and the Nasdaq Composite—have faltered, weighed down by geopolitical instability and monetary uncertainty.

Much of this turbulence stems from the United States. A possible trade war ignited by President Trump, public disputes between Trump and Federal Reserve Chair Jerome Powell, and a sweeping sell-off of U.S. Treasuries have driven the dollar to a three-year low. As traditional markets tremble, investors are gravitating toward safe-haven assets—most notably gold, which is nearing an all-time high of $3,500 per ounce. But Bitcoin, often dubbed “digital gold,” is now sharing that spotlight.

Online advertising service 1lx.online

At the heart of this trend lies the fragility of centralized monetary systems. Bitcoin was born in response to such vulnerabilities, offering an alternative to fiat currencies controlled by state authorities. Unlike the inflation-prone dollar, Bitcoin is governed by mathematical scarcity and decentralized issuance. Its design inherently resists manipulation—making it increasingly appealing in politically chaotic times.

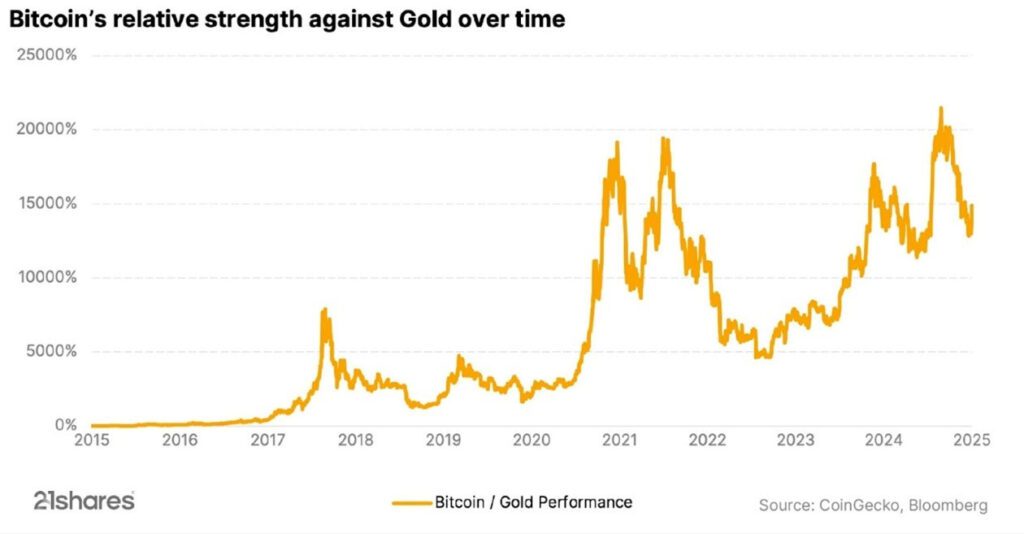

This divergence isn’t just theoretical; history supports it. Back in 2018–2019, confrontations between Trump and the Fed rocked both equities and Bitcoin. But today, with broader adoption, Bitcoin is writing a new script. Institutional investors now hold the keys to exchange-traded products (ETPs) that bridge traditional finance and crypto. This growing accessibility enhances Bitcoin’s credibility as a modern safe-haven.

Indeed, in April 2025 alone, U.S. Bitcoin ETFs saw daily inflows exceeding $1 billion, much of it during American trading hours—emphasizing the asset’s growing alignment with investor sentiment during market hours once reserved solely for equities.

As the Fed’s independence comes under rhetorical fire and trust in central banks diminishes, Bitcoin’s core proposition—decentralized value—gains clarity. The more Washington wavers, the more crypto solidifies its role.

While gold remains the classic hedge, Bitcoin is rapidly becoming its digital reflection. Yet this is a fragile alignment. Should global tensions abate or monetary clarity return, Bitcoin’s behavior may decouple once again. But for now, the path seems clear: in times of uncertainty, Bitcoin is not only surviving—it’s thriving.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)