Bitcoin Bulls Reclaim Momentum as Risk-Off Signal Hits Zero, Says Swissblock

Swissblock reports Bitcoin Risk-Off Signal at zero, signaling diminishing downside risks and a potential major rally as bullish momentum builds.

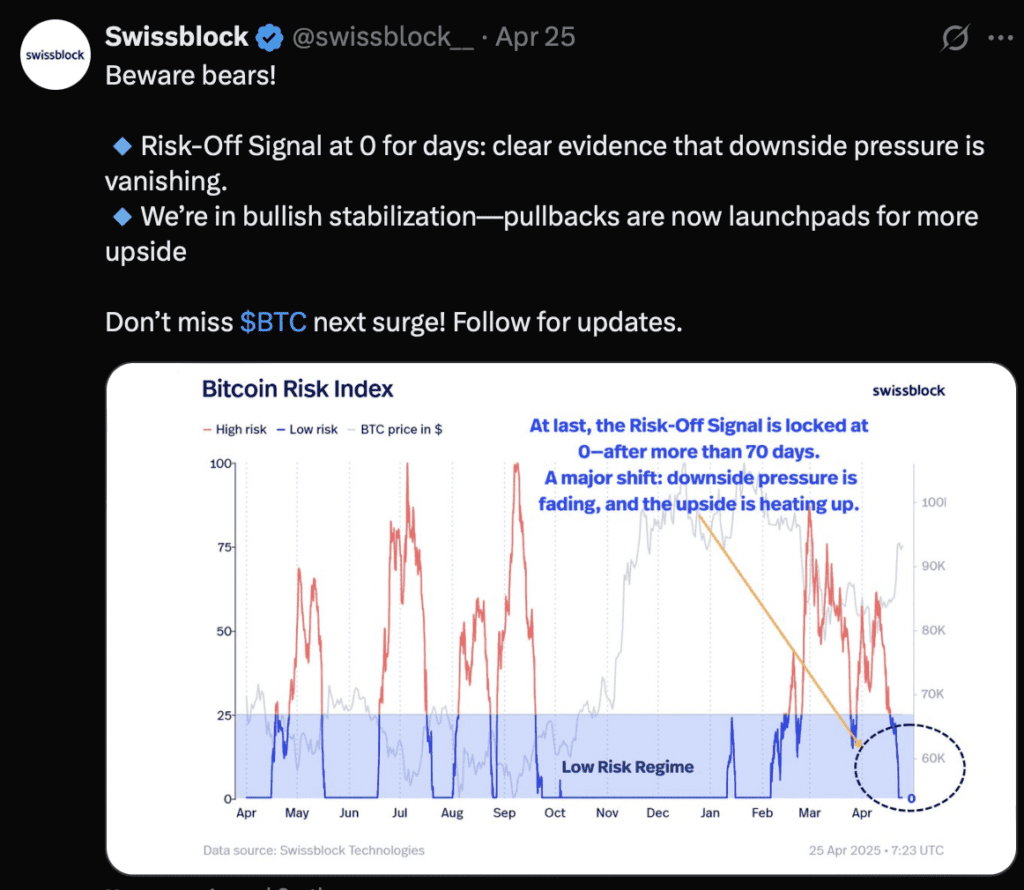

April 26, 2025 – After months of cautious sentiment, Bitcoin bulls appear to be firmly back in control. According to leading analytics firm Swissblock, the Risk-Off Signal—a critical measure of market downside pressure—has dropped to zero and stayed there for several consecutive days, signaling a dramatic shift in Bitcoin’s underlying dynamics.

This rare occurrence often marks the end of major selling pressure and heralds the beginning of new bullish phases. Swissblock’s analysis shows that the Bitcoin market has transitioned from fragile recovery to bullish stabilization, where pullbacks are now launchpads for upside momentum rather than signs of deeper corrections.

Online advertising service 1lx.online

“Don’t miss Bitcoin’s next surge,” Swissblock urged in its latest report.

🔥 Risk Conditions Improve Sharply

Swissblock’s Bitcoin Risk Index—a proprietary blend of liquidity, sentiment, and volatility metrics—confirms that downside risks have rapidly diminished. The Risk-Off Signal remaining locked at zero for the first time in over 70 days is historically significant.

Past cycles where the Risk-Off Signal zeroed out have often preceded sharp upward price movements within weeks, sometimes catalyzing multi-month rallies.

📈 Bitcoin Price Stability Builds Confidence

Bitcoin’s recent stabilization near $94,000–$95,000 levels adds weight to Swissblock’s outlook. Despite minor market fluctuations, BTC has managed to defend key support zones, suggesting that selling exhaustion has taken hold.

The improved macro sentiment, increased liquidity, and resurgence of institutional interest via ETFs and spot markets further reinforce bullish expectations.

🌍 Sentiment Across Crypto Turns Positive

Online advertising service 1lx.online

Beyond Bitcoin, the broader crypto market is starting to mirror this optimism. Altcoins are showing resilience, trading volume is rising, and funding rates across derivatives platforms are stabilizing—common hallmarks of an impending rally.

Traders are now shifting their risk profiles, moving away from defensive postures toward strategic long positions across Bitcoin and select altcoins.

As Swissblock notes, if historical patterns hold true, the crypto market could be on the brink of its next major bull phase—with Bitcoin leading the charge once again.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)