Bitcoin Breaks $100K on New Buyer Surge—But Momentum Traders Pose a Hidden Risk

Bitcoin hits $105K as new investor demand surges. But low momentum buyer conviction could stall further upside unless sentiment shifts soon.

Bitcoin (BTC) has officially crossed the $100,000 mark, reaching as high as $105,000 in recent days. This surge, up from $93K just a week ago, has captured analyst attention and market headlines alike.

According to blockchain analytics firm Glassnode, the primary driver of this rally appears to be a wave of new investor participation, not seasoned traders or whales. Their data shows first-time buyers’ Relative Strength Index (RSI) has remained at a constant 100, suggesting persistent new demand entering the market.

Online advertising service 1lx.online

This indicator reflects a pattern typically seen during early bull market phases, when fresh capital begins to accumulate positions. Glassnode’s supply tracking confirms this trend, citing consistent inflows from new market entrants throughout the week.

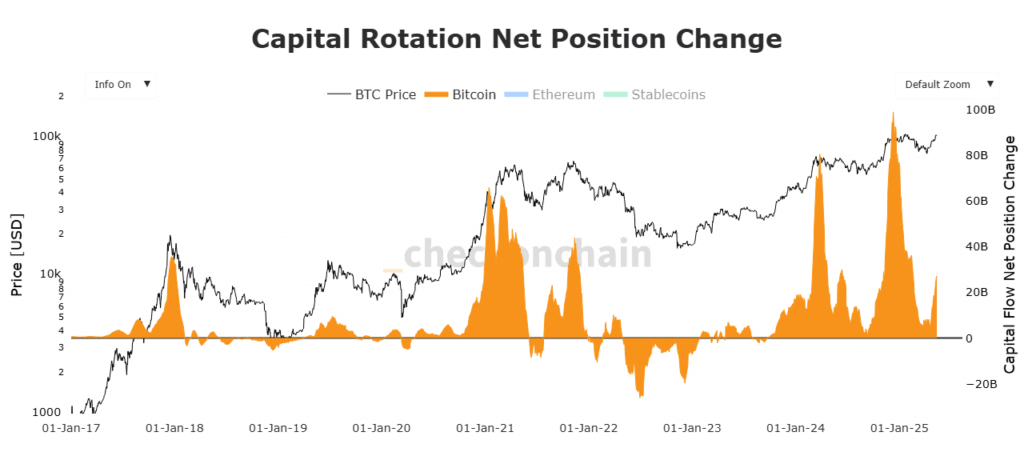

Further fueling this rise, the market has seen $6 billion in newly issued USDT injected in the past 20 days. This influx of liquidity has coincided with more BTC withdrawals from exchanges, with exchange netflows dropping to a weekly low of 1,600 BTC. This signals greater buying than selling pressure, reinforcing the idea of an expanding holder base.

Yet, despite this encouraging sign of adoption, one critical cohort remains absent: momentum traders.

While new buyers dominate, momentum buyer conviction is near historic lows, with Momentum RSI hovering around 11. This signals hesitation or lack of participation from short-term speculators—typically the traders who help drive parabolic gains during breakout phases.

Historically, sustained Bitcoin rallies require participation from both early adopters and momentum buyers. Without the latter, rallies often stall or reverse, as the market lacks the acceleration needed to breach key resistance levels.

The current split in sentiment paints a complex picture: while institutions, retail investors, and even long-absent whales are seeing Bitcoin as a legitimate investment vehicle, short-term traders remain on the sidelines—waiting, perhaps, for a stronger signal or validation before entering in size.

Online advertising service 1lx.online

Unless this momentum cohort re-engages, Bitcoin may remain trapped between $100K and $105K, unable to decisively push to new highs. However, if momentum shifts, BTC could be primed for a breakout beyond resistance, setting the stage for the next all-time high.

Our creator. creates amazing NFT collections!

Support the editors - Bitcoin_Man (ETH) / Bitcoin_Man (TON)

Pi Network (Guide)is a new digital currency developed by Stanford PhDs with over 55 million participants worldwide. To get your Pi, follow this link https://minepi.com/Tsybko and use my username (Tsybko) as the invite code.

Binance: Use this link to sign up and get $100 free and 10% off your first months Binance Futures fees (Terms and Conditions).

Bitget: Use this link Use the Rewards Center and win up to 5027 USDT!(Review)

Bybit: Use this link (all possible discounts on commissions and bonuses up to $30,030 included) If you register through the application, then at the time of registration simply enter in the reference: WB8XZ4 - (manual)